A Revision of the S&P 500 Wave Degrees: Wave 2{-6} Changed to Wave 2{-2}

The present wave 2 upward correction on the S&P 500 index and futures charts has been with us since October 13, 2022. And as the wave’s lifespan has extended, it has become increasingly clear my labeling of the subwaves considers them to be further down the complex wave structure than they have turned out to be.

Every analysis I post contains a quote from the 20th century semanticist Alfred Korzybski. In his book Science and Sanity, published 90 years ago in 1933, he wrote “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.”

And in every post I add, “… in the ever-changing markets, we can judge that similarity of structure only after the fact.”

After considering the evidence, I’ve concluded that the degree given to the wave 2 correction no longer matches the reality on the chart. The map no longer matches the territory, and when that happens, what do the explorers do? They redraw the map.

This essay describes the process by which I reached my conclusion and how I’ve redrawn the map.

Elliott Wave Theory is a technique for recognizing patterns in waves, the price movements of markets over time.

Pattern recognition, as it turns out, is something the human brain is good at. Back in the days when our ancestors lived in small bands gathering wild plants and hunting wild animals for food, those pattern recognition skills enabled them to find the beneficial and avoid the dangerous as they spent their days navigating a very large landscape.

Applying numbers to those patterns, however, really didn’t do much to help our nomadic ancestors put food on the table.

In my four decades of working with Elliott Wave Theory, I’ve been helped and hindered by those same strengths and weaknesses over and over again.

A wave on the chart has two aspects: One is its position in the pattern. The other is the relative size of the pattern compared to the larger and smaller structures that make up its chart. That relative size is the wave’s degree.

It only takes a glance at a chart to know that it is more than the simple ups and downs that are the focus of stock market news stories. The chart is a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

When R.N. Elliott developed Elliott Wave Theory in the 1930s, he combined the two aspects of the wave in a single name, anticipating that traders using his method would quickly learn that an Intermediate wave pattern is contained within a Primary wave, or that a SuperCycle wave is home to an entire Cycle wave trend.

For my analysis, I choose to make the two aspects explicit. I use the wave number, followed by a numerical subscript, in curly brackets, showing the degree relative to the Intermediate degree, which is degree {0}.. For example, a long middle wave is clearly wave 3, and its parent wave has been identified as being of the Intermediate degree, so I label that middle wave 3{-1}, meaning it is one degree below the {0} parent wave.

By the time a trend has reached wave 3 its degree is fairly clear. But what about wave 1, in its first tentative weeks? It has no context within its pattern. Is wave 1 a child of the parent wave? Or a grandchild? Or a great-great-grandchild? There’s no way to know for sure.

There are two approaches to the problem.

The first approach is to consistently label the subwave one degree lower than the parent wave. If that turns out to not match the reality of the chart, it can always be moved one degree lower. How does the trader know when the degree labeling is too large? Elliott said the wave degrees are proportional: An Intermediate degree {0} wave is similar to others the same size. But proportionate, I’ve found, contains a lot of variety. No doubt because of that variety, Elliott didn’t estimate the duration of each degree’s waves. Clearly, he concluded that it’s a subjective judgment call.

The second approach is to put some distance between the parent wave and the subwave, assuming that the wave in its early stages is several degrees removed from the parent wave. If degree labeling proves to be too small, it can always be raised to a higher degree.

For the second approach, unlike with the first approach, Elliott wave analysis provides a clear signal when a pattern’s degree is too small. If the 2nd wave a pattern moves beyond the starting point of the 1st wave, then the analysis is no longer valid –the map no longer matches the territory and must be redrawn. Usually the reanalysis takes the form of switching the labeling to a larger degree.

I tend to favor the second approach because it is associated with a clear signal when a reanalysis is needed. Long-time readers will recall that this has happened several times as our present long-running correction has progressed.

Even if there is no clear signal, the need for proportionality is still important. And that is what has happened to the present correction.

In the following discussion, I’ve used the dates from the S&P 500 E-mini futures chart, which I analyze daily. The dates from the S&P 500 index might vary by a day or so.

The present correction is wave 2{-6}, at what Elliott called the Minuscule degree. It is a subwave of wave 4{-1}, a downtrend that began on January 4, 2022 and which is in turn is a subwave of wave 5{0}, an expanding Diagonal Triangle that began in December 2018.

Within wave 4{-1}, wave 1{-6} had a duration of 0.8 years. The following wave 2{-6} has been underway for 0.7 years. Both 1st and 2nd waves tend to be on the short short side, as they set up for the longer-lasting 3rd wave to come.

By comparison, the corresponding subwaves within wave 3(-1}, the preceding uptrend, were 0.5 years for wave 1{-2} and 0.2 years for the following correction, wave 2{-2}. That’s shorter than the distances of the waves of the {-6} degree under my present analysis, but not by much. That suggests to me that raising the degree of subwaves of wave 4{-1} would bring the analysis more in line with the reality of the chart.

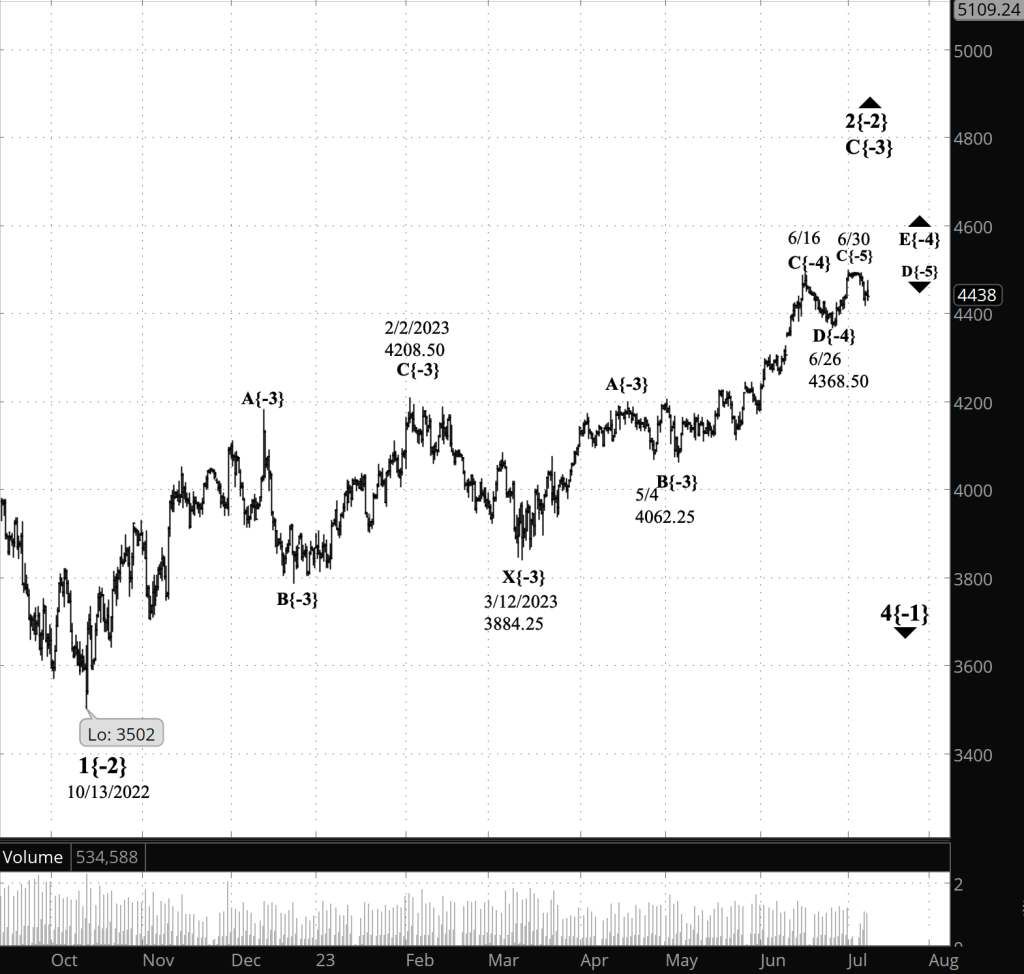

So, beginning Monday, wave 2{-6} becomes wave 2{-2}, with all of its subwave degrees also raised up four levels. Here’s a close-up chart of the S&P 500 futures showing the upward correction that began on October 13, 2022:

[S&P 500 E-mini futures, 7/7/2023 close , 9-hour bars, with volume]

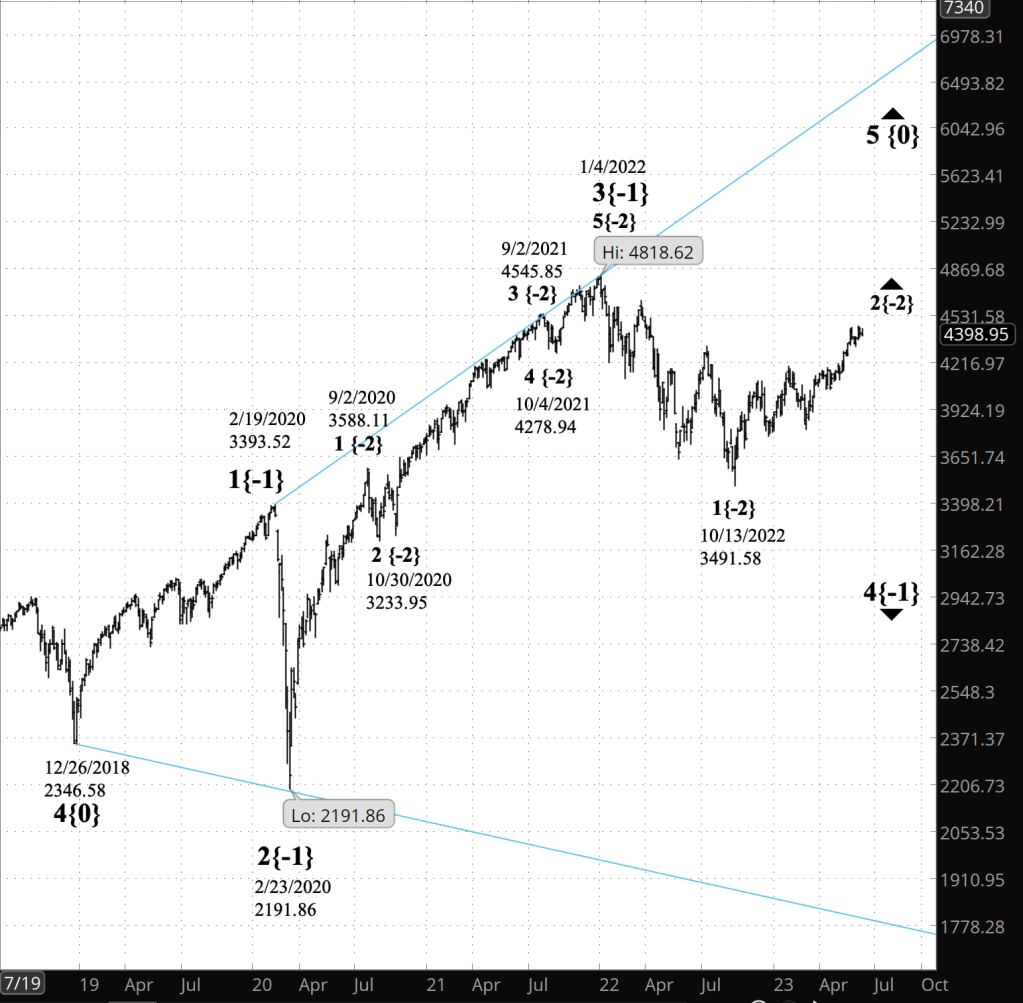

And here’s a longer view showing the entirety of the Expanding Diagonal Triangle that began on December 26, 2018.

[S&P 500 index, 7/7/2023 close , 3-day bars]

We Are Here.

These are the waves currently in progress under my principal analysis. Each line on the list shows the wave number, with the subscript in curly brackets, the traditional degree name, the starting date, the starting price of the S&P 500 E-mini futures, and the direction of the wave.

- S&P 500 Index:

- 5{+3} Supercycle, 7/8/1932, 4.40 (up)

- 5{+2} Cycle, 12/9/1974, 60.96 (up)

- 5{+1} Primary, 3/6/2009, 666.79 (up)

- 5{0} Intermediate, 12/26/2018, 2346.58 (up)

- S&P 500 Futures and index:

- 4{-1} Minor, 1/4/2022, 4953.25 (down) (futures), 4818.62 (down) (index)

- S&P 500 Futures:

- 2{-2} Minute, 10/13/2022, 3577.75 (up)

Learning and other resources. Elliott wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott wave analysis.

By Tim Bovee, Portland, Oregon, July 9, 2023

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.

[…] than they should be, by four degrees. I posted a Trader’s Notebook on Sunday, July 9, titled “Trader’s Notebook: New Wave Degrees”. It describes the problem of degree setting, which is a major ambiguity endemic to Elliott wave […]

LikeLike