3:30 p.m. New York time

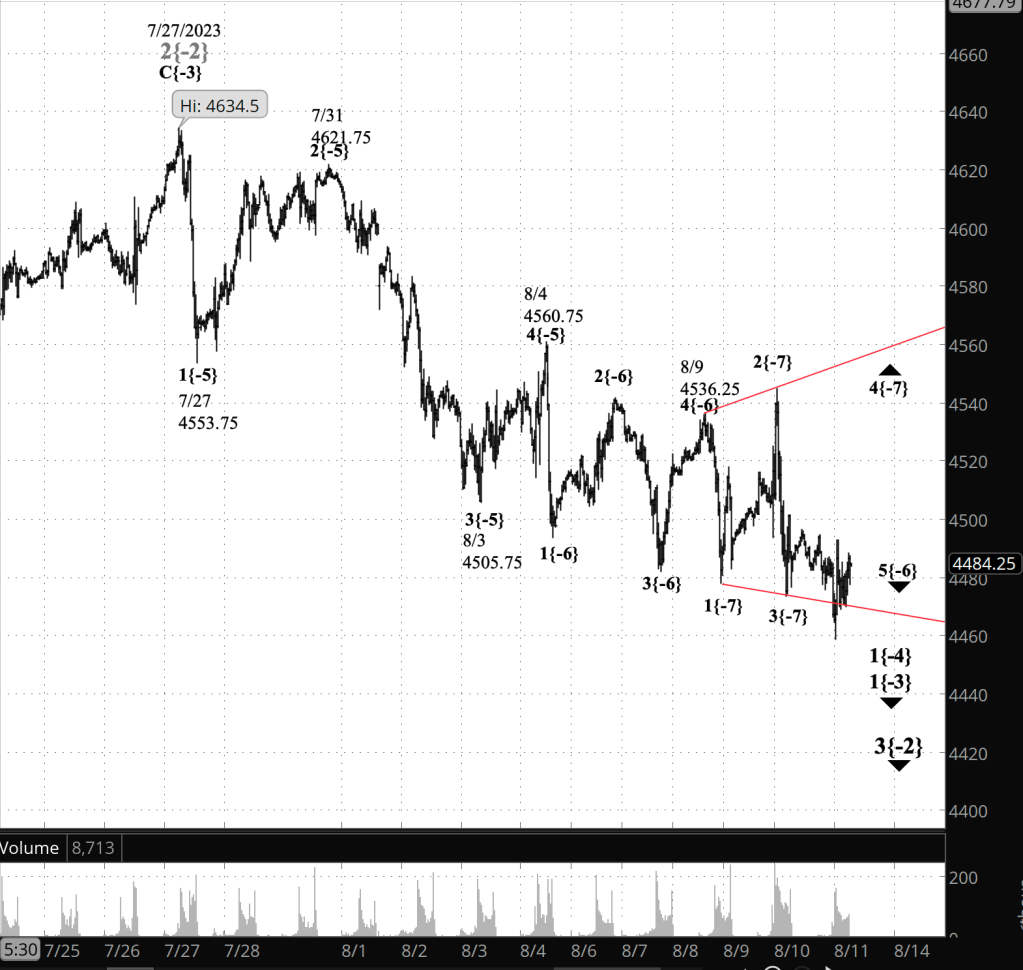

Half an hour before the closing bell. The S&P 500 futures meandered between the 4460s and the 4470s, repeatedly bouncing off the lower boundary of the expanding Diagonal Triangle that began on August 9. This morning’s analysis is unchanged. I’ve updated the chart.

9:35 a.m. New York time

What’s happening now? The S&P 500 E-mini futures hit a high in the 4490s early in overnight trading and then declined, dropping sharply by 15 points when the Producer Price Index was released an hour before the opening bell.

What does it mean? The price decline bounced off of the lower boundary of an expanding Diagonal Triangle that began on August 9. It is the final wave within a low-degree downtrend that began on August 4, which is part of a much larger 3rd wave downtrend that began on July 27 from 4634.50 and which will eventually carry the price below 3500, perhaps significantly below that level.

The Triangle’s boundaries are marked on the chart in red.

Internally, the Triangle has completed three subwaves and is now in its rising 4th subwave, which will end around the upper boundary of the Triangle, presently in the 4550s and rising every minute, and will reverse downward as the 5th and final subwave.

The larger downtrend is wave 3{-2}, and the present expanding Diagonal Triangle is wave 5{-6}, four degrees smaller from than the downtrend. Internally, the Triangle is in rising wave 4{-7}.

A larger upward correction will follow, a 2nd wave that will take back a portion of the decline since July 27 and that will remain below 4634.50.

What are the alternatives? Unchanged from the day before.

Alternative #1:

- Wave 2{-2}, and upward compound correction that began on October 13, 2022 completed a second corrective pattern on July 27.

- The subsequent decline is wave X{-3}, a downward connector between the second corrective pattern and the future third corrective pattern.

- Once the third corrective pattern within wave 2{-2} has ended, a powerful downtrend, wave 3{-2}, will follow.

Alternative #2:

- I have listed the Triangle as being the from of wave 5{-6}. It’s still early days in the decline from July 27, and that wave’s degree could be higher — wave 5{-5} or wave 5{-4}.

[S&P 500 E-mini futures at 9:35 a.m., 30-minute bars, with volume]

What does Elliott wave theory say? Here are the waves that underly the analyses.

Principal analysis:

- A downward correction, wave 3{-2}, began on July and is underway.

- Internally, the correction is in its first subwave, wave 1{-3}.

- Within wave 1{-3}, things become a bit more ambiguous, since the precise degree of the subwaves won’t become clear until the downtrend has progressed further.

- I’ve chosen, as a guess, to label the subwave of wave 1{-3} as being in its first wave, 1{-4}, which in turn is in its final subwave, wave 5{-5}.

- The final subwave within wave 5{-5} began overnight. Declining wave 5{-6} is now underway.

- Wave 5{-6} is its 2nd of five subwaves, an upward correction designated wave 2{-7}.

Alternative analysis #1:

- Wave 2{-2}, and upward compound correction that began on October 13, 2022 completed a second corrective pattern on July 27.

- The subsequent decline is wave X{-3}, a downward connector between the second corrective pattern and the future third corrective pattern.

- Once the third corrective pattern within wave 2{-2} has ended, a powerful downtrend, wave 3{-2}, will follow.

Alternative analysis #2:

- The Diagonal Triangle is wave 5{-5} within declining wave 1{-4} within wave 1{-3}, the first subwave within the downtrend, wave 3{-2}, that began on July 27.

- Or it could be one degree higher, wave 5{-4} within wave 1{-3} within wave 3{-2}.

We Are Here.

These are the waves currently in progress under my principal analysis. Each line on the list shows the wave number, with the subscript in curly brackets, the traditional degree name, the starting date, the starting price of the S&P 500 E-mini futures, and the direction of the wave.

- S&P 500 Index:

- 5{+3} Supercycle, 7/8/1932, 4.40 (up)

- 5{+2} Cycle, 12/9/1974, 60.96 (up)

- 5{+1} Primary, 3/6/2009, 666.79 (up)

- 5{0} Intermediate, 12/26/2018, 2346.58 (up)

- S&P 500 Futures and index:

- 4{-1} Minor, 1/4/2022, 4953.25 (down) (futures), 4818.62 (down) (index)

- S&P 500 Futures:

- 3{-2} Minute, 7/27/2023, 3502 (down)

Reading the chart. Price movements — waves – – in Elliott wave analysis are labeled with numbers within trending waves and letters with corrective waves. The subscripts — numbers in curly brackets — designate the wave’s degree, which, in Elliott wave analysis, means the relative position of a wave within the larger and smaller structures that make up the chart. R.N. Elliott, who in the 1930s developed the form of analysis that bears his name, viewed the chart as a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

Learning and other resources. Elliott wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott wave analysis.

By Tim Bovee, Portland, Oregon, August 11, 2023

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.

You must be logged in to post a comment.