3:30 p.m. New York time

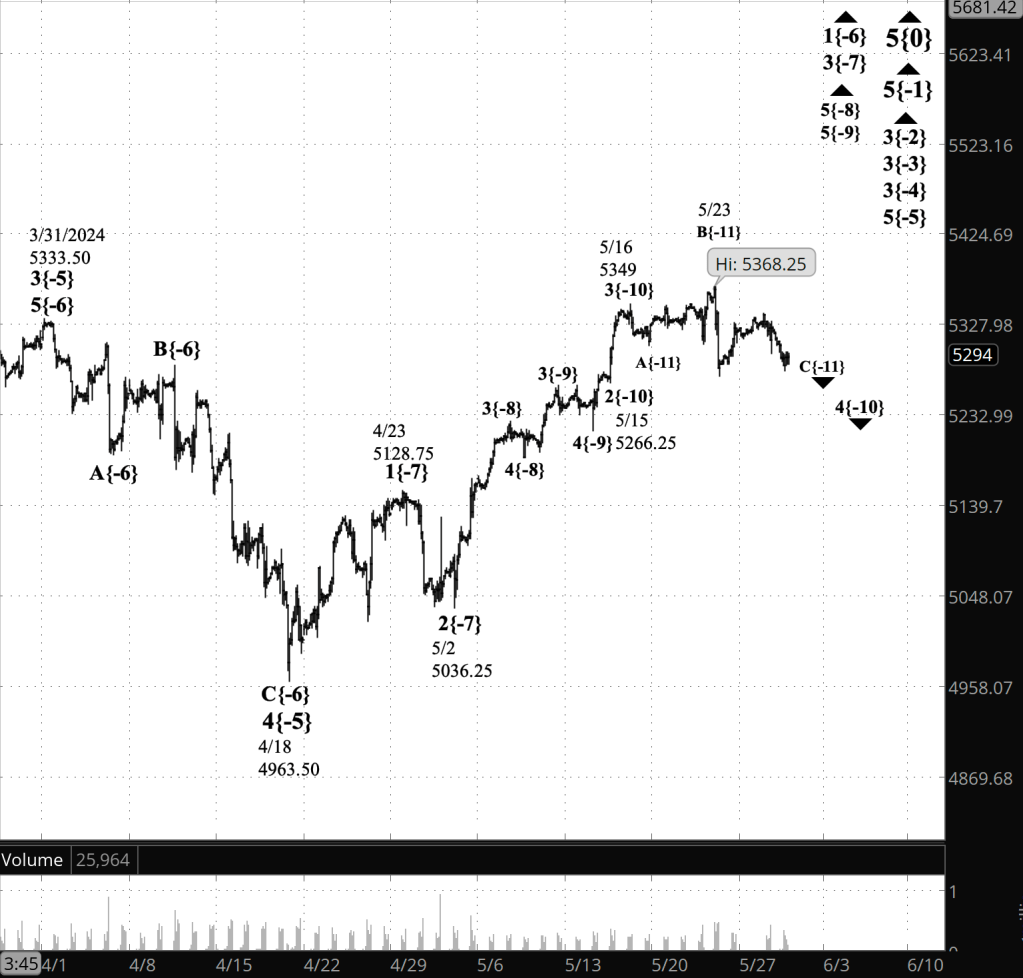

Half an hour before the closing bell. The S&P 500 futures went nowhere during the session, bouncing between the 5280s and the 5290s. Elliott Wave Theory sees the pattern as a small correction within the larger final subwave — wave C — of the 4th-wave downtrend that began on May 16.

I’ve updated the chart.

9:35 a.m. New York time

What’s happening now? The S&P 500 E-mini futures fell steadily overnight, from the 5320s to the 5270s.

Elliott Wave Theory. The final subwave of the 4th-wave downward correction that began on May 16 continues. The final subwave, wave C, began on May 23 and is in the 3rd of five still smaller subwaves. The correction is 10 degrees lower than Intermediate degree. The present Intermediate degree, a 5th wave within an uptrend, began in December 2018. So the correction is quite small, yet it’s end will echo up the fractal structure of the chart, causing larger changes.

Looking ahead. The completion of the 4th wave will also mark the end of two 5th waves uptrends of increasing size, and a still larger 3rd wave uptrend that began on May 2. Another 4th-wave downward correction will follow, three degrees larger than the correction now underway, with a correspondingly larger impact on the markets.

All of this is happening within a still larger 1st wave uptrend. Maybe…

What are the alternatives? That 1st wave, four degrees below Intermediate degree, began on April 18 according to the principal analysis. I inserted the 1st wave after comparing the length of time taken by previous similar waves of similar degree.

That’s suggestive, but not a certainty. It’s also possible that there is no 1st wave, and instead, that the four smaller waves on the chart below wave 1 — labeled 4{-10}, 5{-9}, 5{-8} and 3{-7} — are one degree larger, eliminating the next higher degree. In that case, wave 1{-6} ended on April 23. See the Reading the Chart section below for an explanation of wave labeling, including the curly brackets.

[S&P 500 E-mini futures at 3:30 p.m., 115-minute bars, with volume]

Waves on the chart. Here are the Elliott waves that underly the analyses.

Principal Analysis:

- Rising wave 5{0} is underway. It is a wave of Intermediate degree that began in December 2018.

- It is in its final subwave, wave 5{-1}.

- Within wave 5{-1}, rising waves 3{-2}, 3{-3} and 3{-4} are underway, as is wave 5{-5}.

- Wave 1{-6} is underway and is in its middle subwave, wave 3{-7}, which is in its final subwave, wave 5{-8}.

- Wave 5{-8} is in its final subwave, wave 5{-9}, which is in its next-to-the-last subwave, wave 4{-10}.

- Within wave 4{-10}, the final subwave, wave C{-11}, is underway.

Reading the chart. Price movements — waves – – in Elliott wave analysis are labeled with numbers within trending waves and letters with corrective waves. The subscripts — numbers in curly brackets — designate the wave’s degree, which, in Elliott wave analysis, means the relative position of a wave within the larger and smaller structures that make up the chart. R.N. Elliott, who in the 1930s developed the form of analysis that bears his name, viewed the chart as a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

Learning and other resources. Elliott wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott wave analysis.

By Tim Bovee, Portland, Oregon, May 29, 2024

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.

You must be logged in to post a comment.