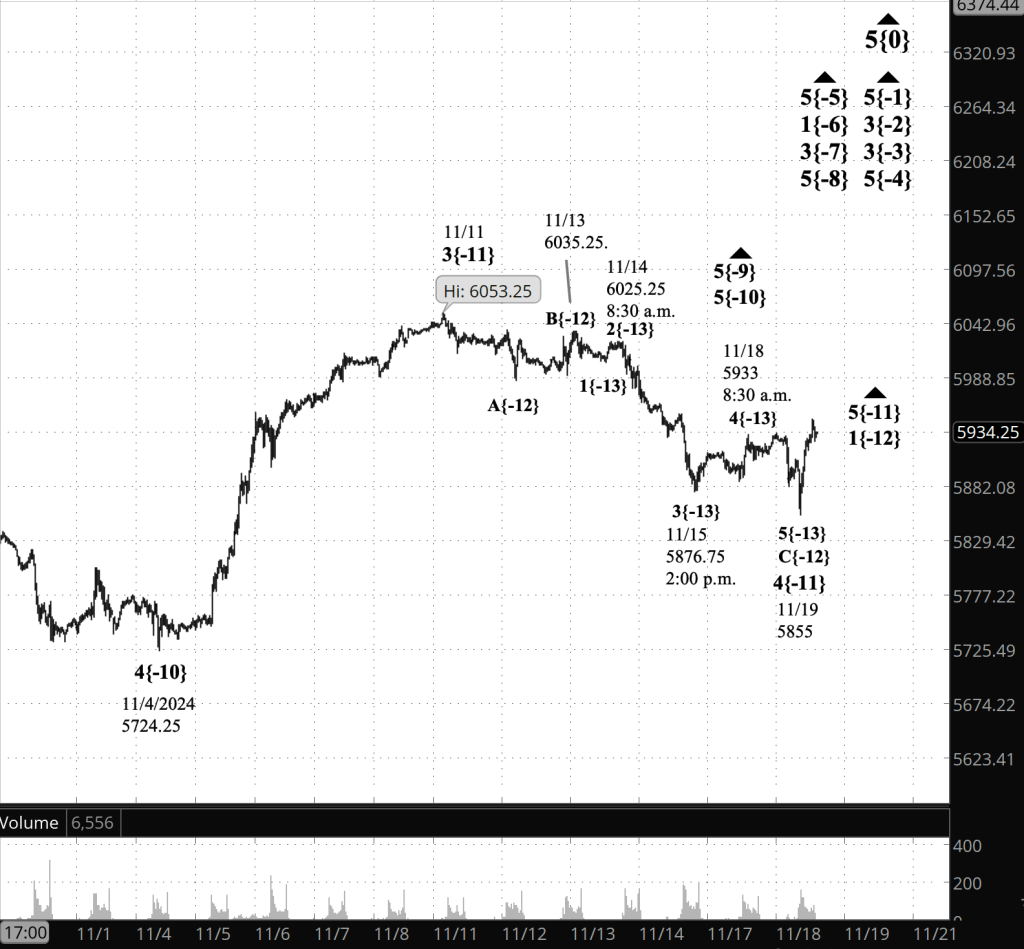

3:30 p.m. New York time

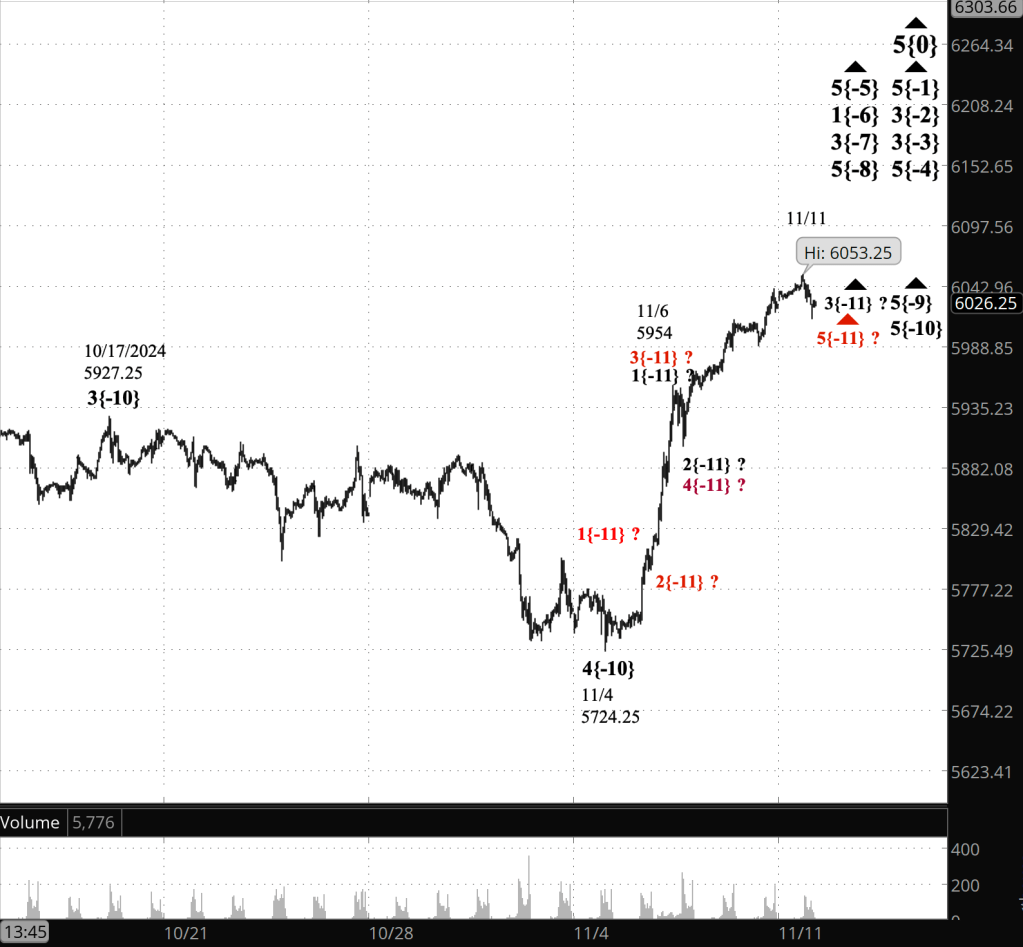

Half an hour before the closing bell. Having fallen to the 5880s at the opening bell, the S&P 500 futures rose gradually, reaching above 5900 as the closing bell approached.

Nothing in the session changed the Elliott Wave analysis published in the morning. The uptrending 5th wave that began on August 18 continues.

9:35 a.m. New York time

What’s happening now? The S&P 500 E-mini futures traded sideways overnight, remaining within a range from the 5930s to 5950s.

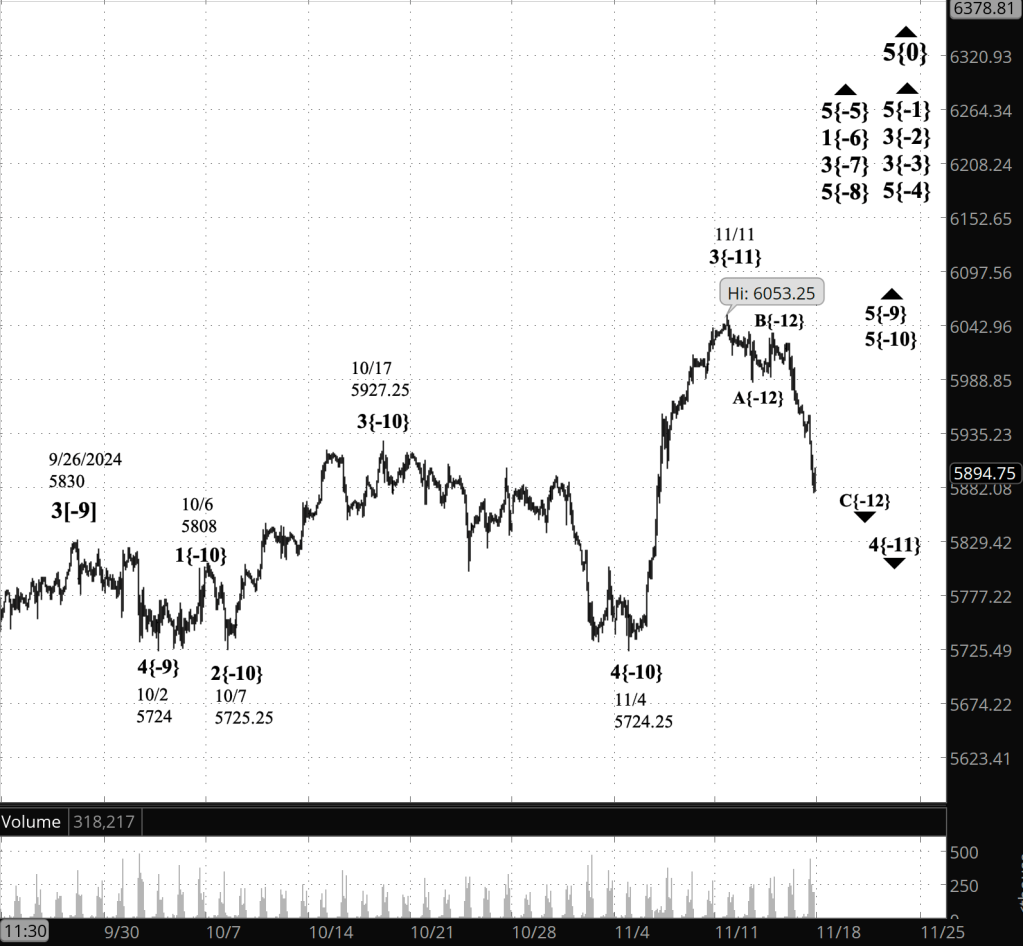

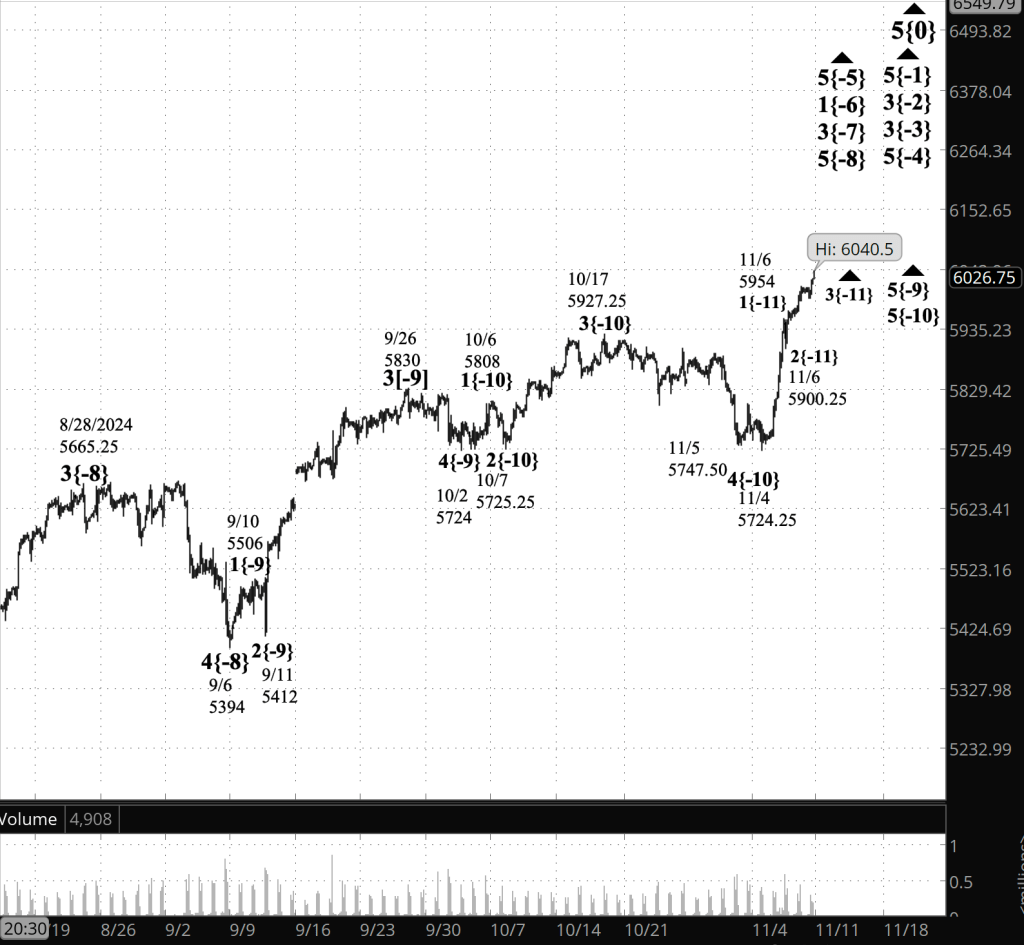

What does it mean? Elliott Wave Theory analysis sees the overnight movement within the early stages of the uptrending 5th wave that began on November 19. It is part of a series of 5th waves of increasing magnitude within the fractal structure of the chart.

Wave labels on the chart have a number or letter designator for each wave, and a subscript in curly brackets shows the wave’s position in the fractal structure relative to the Intermediate degree, labeled wave 5{0}, which began in December 2018.

The 5th wave that began on November 19, wave 5{-11}, is eleven levels below Intermediate degree.

A typical 5th wave will move above the end of the preceding 3rd wave — wave 3{-11} in this case. It ended on November 11 at 6053.25. A 5th wave sometimes ends below that level, a condition called “truncation”, or moves further beyond it than seems reasonable (a condition called “extension”).

When wave 5{-11} is complete, it will simultaneously mark the end of waves 5{-10}, 5{-9} and 5{-8}, and wave 3{-7}, the middle subwave of its parent, wave 1{-6}.

Wave 3{-7} will be followed by a downward correction, wave 4{-7}, and then an uptrending final subwave, wave 5{-7}.

The end of wave 5{-7} will also be the end of the parent wave 1{-6}, which began on August 6.

[S&P 500 E-mini futures at 3:30 p.m., 30-minute bars, with volume]

What are the alternatives? None at present. They will develop, as they always do.

What does Elliott wave theory say? Here are the waves that underly the analyses.

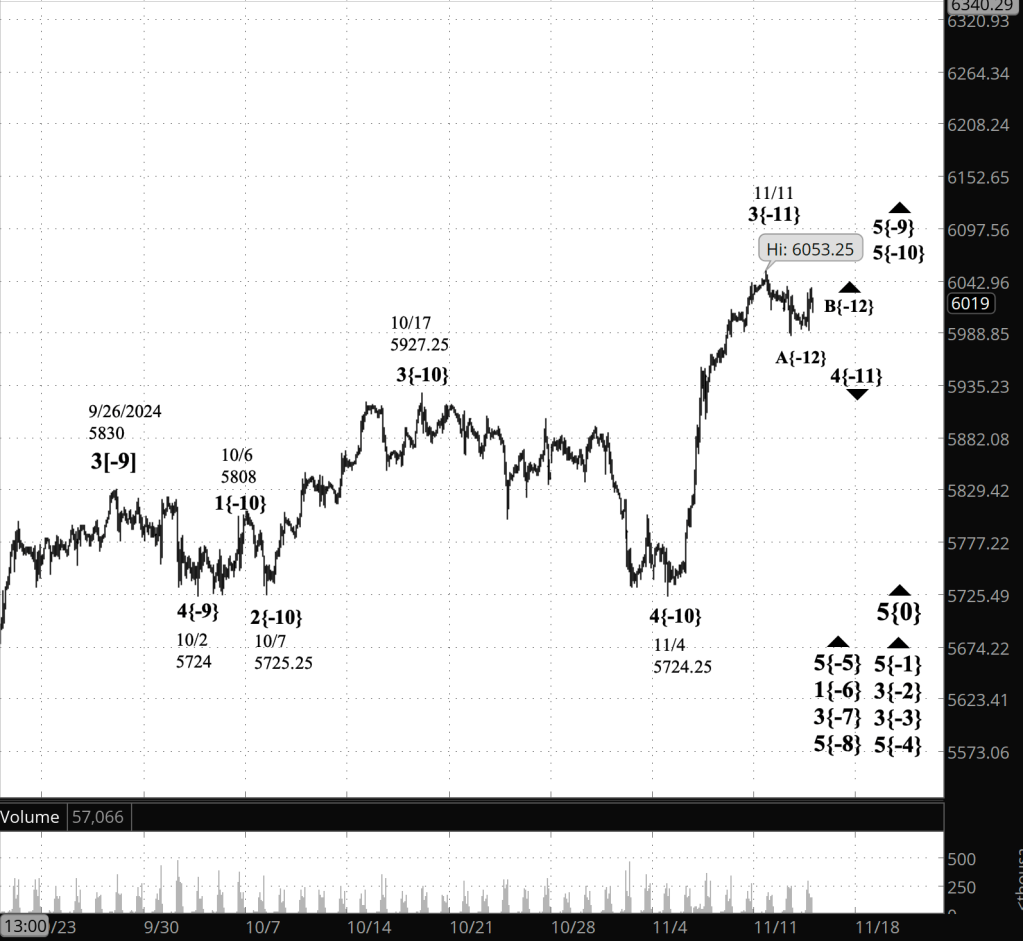

Principal Analysis:

- .Rising wave 5{0} is underway. It is a wave of Intermediate degree that began in December 2018.

- It is in its final subwave, wave 5{-1}.

- Within wave 5{-1}, rising waves 5{-2}, 5{-3} and 5{-4} are underway, as is wave 5{-5}.

- Wave 5{-5} is in its initial subwave, wave 1{-6}, which in turn is in its middle subwave, wave 3{-7}.

- Wave 3{-7} is in its final; subwave, uptrending wave 5{-8}.

- Wave 5{-8} is in its final subwave, wave 5{-9}, which is in its final subwave, uptrending wave 5{-10}.

- Wave 5{-10} is in its final subwave, wave 5{-11}.

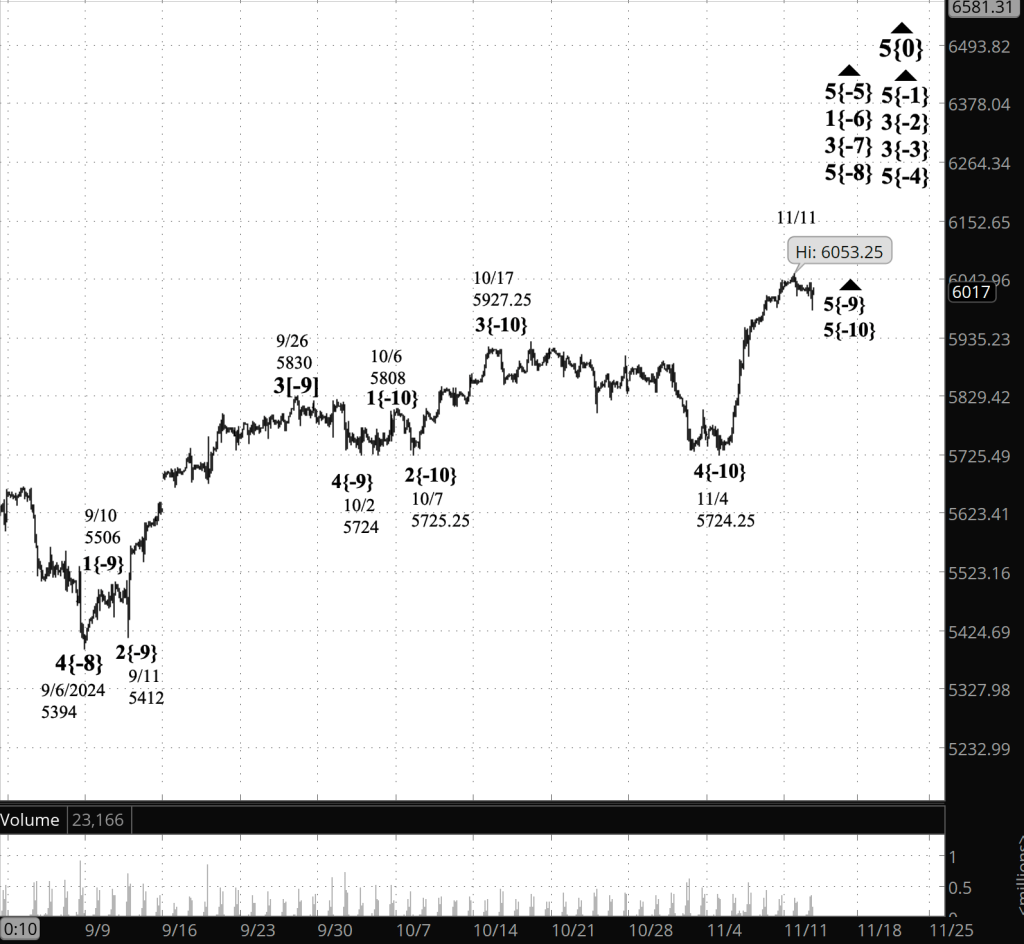

Long-term Waves.

These are the waves currently in progress under my principal analysis. Each line on the list shows the wave number, with the subscript in curly brackets, the traditional degree name, the starting date, the starting price of the S&P 500 E-mini futures, and the direction of the wave.

- S&P 500 Index:

- 5{+3} Supercycle, 7/8/1932, 4.40 (up)

- 5{+2} Cycle, 12/9/1974, 60.96 (up)

- 5{+1} Primary, 3/6/2009, 666.79 (up)

- 5{0} Intermediate, 12/26/2018, 2346.58 (up)

- S&P 500 Futures

- 5{-1} Minor, 10/27/2023, 4127.25 (up)

- 3{-2} Minute, 10/27/23, 4127.75 (up)

- 3{-3} Minuette, 10/27/23, 4127.75 (up)

- 5{-4} Subminuette, 4/18/2024, 4963.50 (up)

- 5{-5} Micro, 8/5/2024, 5120 (up)

- 1{-6} Submicro, 8/5/2024, 5120 (up)

- 3{-7} Minuscule, 8/7/2024, 5182 (up)

- 5{-8} (unnamed), 9/6/2024, 5394 (up)

- 5{-9} (unnamed), 10/2/2024, 5724 (up)

- 5{-10} (unnamed), 11/4/2024, 5824.25 (up)

- 5{-11} (unnamed), 11/19/2024, 5933 (up)

Reading the chart. Price movements — waves – – in Elliott wave analysis are labeled with numbers within trending waves and letters with corrective waves. The subscripts — numbers in curly brackets — designate the wave’s degree, which, in Elliott wave analysis, means the relative position of a wave within the larger and smaller structures that make up the chart. R.N. Elliott, who in the 1930s developed the form of analysis that bears his name, viewed the chart as a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

Learning and other resources. Elliott wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott wave analysis.

By Tim Bovee, Portland, Oregon, November 20, 2024

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.

You must be logged in to post a comment.