3:30 p.m. New York time

Half an hour before the closing bell. the S&P 500 futures has reached a session high of 6936.25. In doing so, the “gotcha” I warned about in the morning analysis has come to pass. Time to rewrite the analysis.

Elliott Wave Theory. A firm rule is that a 2nd wave cannot move beyond the start of the preceding 1st wave. If it does, then the labels no longer fit reality.

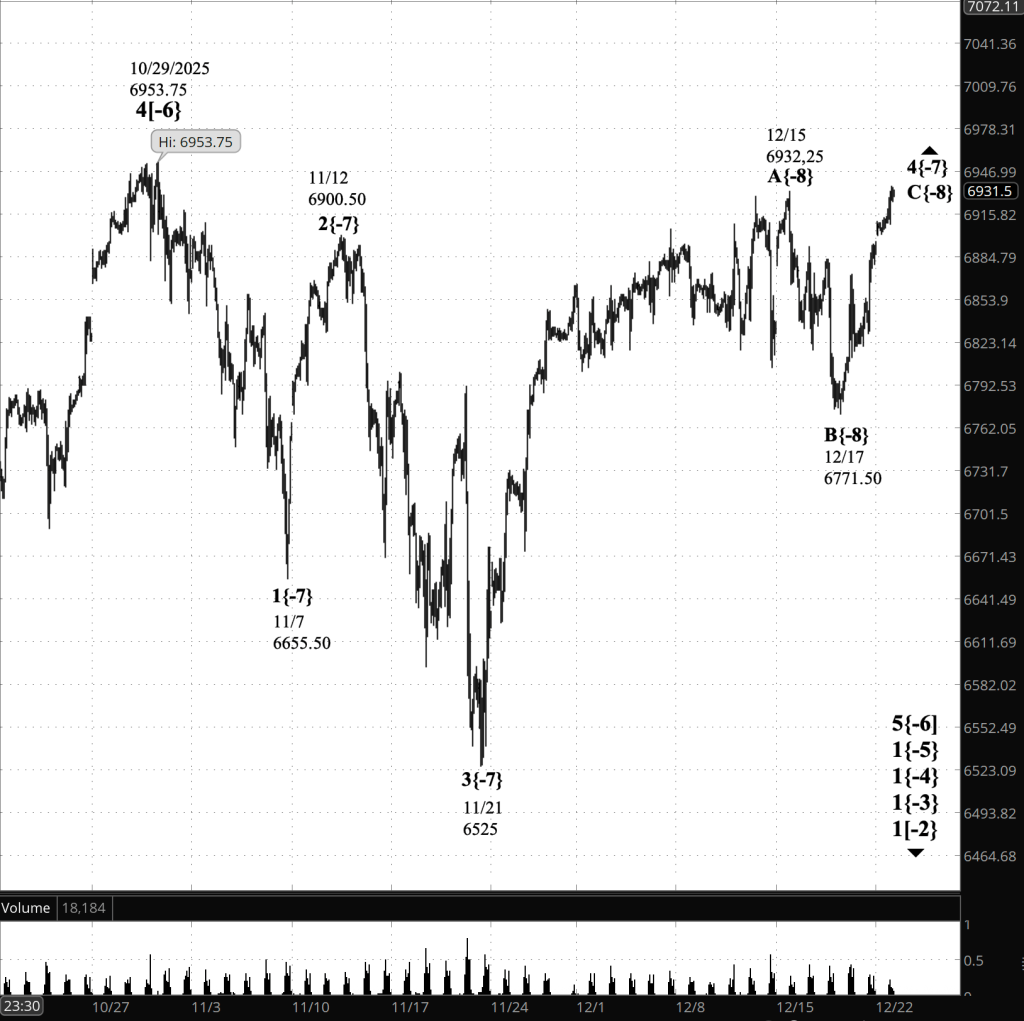

Here, then, is the new reality:

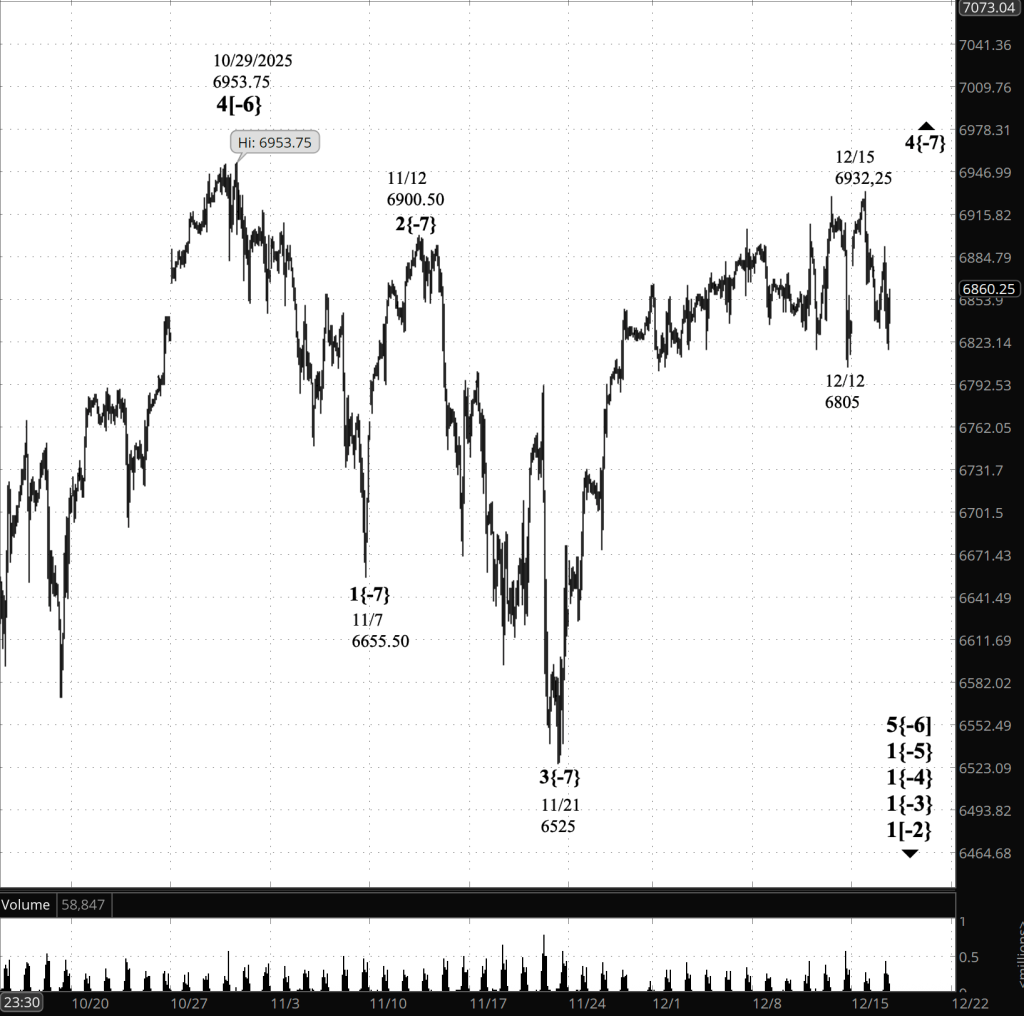

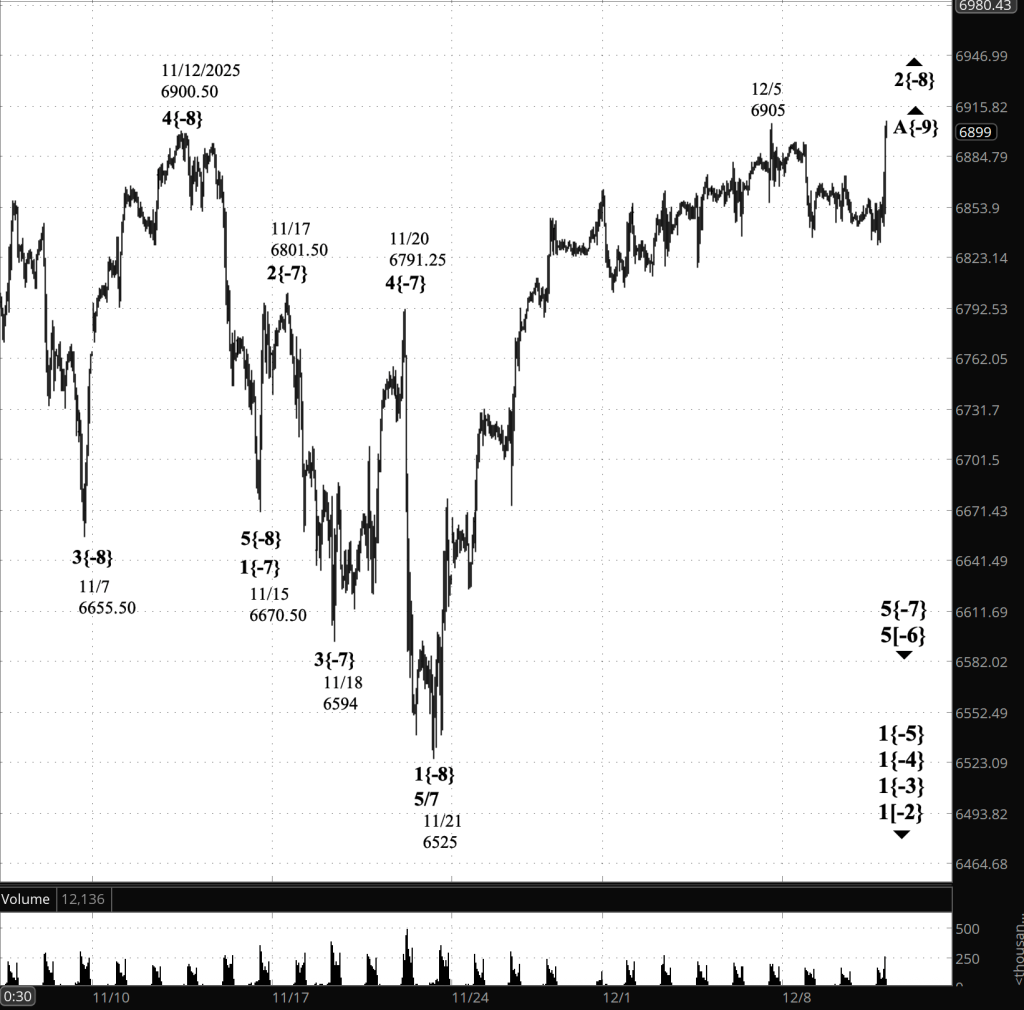

Everything we’ve been tracking on the chart, from November 21 to the present day, is part of wave 4{-7}. Our earlier analyses had wave 4{-7} ending on December 15, which today’s high proves was incorrect.

Under the revised count, wave 4{-7} is still underway, and the decline that began on December 15 is a subwave within wave 4{-7}. Specifically, wave A{-8}, the first subwave of wave 4{-7}, ended on December 15 at 6932.25. Wave B{-8} carried price down to its end on December 17 at 6771.50. Rising wave C{-8}, having begun on December 17, is now underway and has reached the 6930s.

And what about wave 5{-7}? Until we see a clean 5-wave decline out of this region, wave 5{-7} remains a forecast, not a fact.

9:35 a.m. New York time.

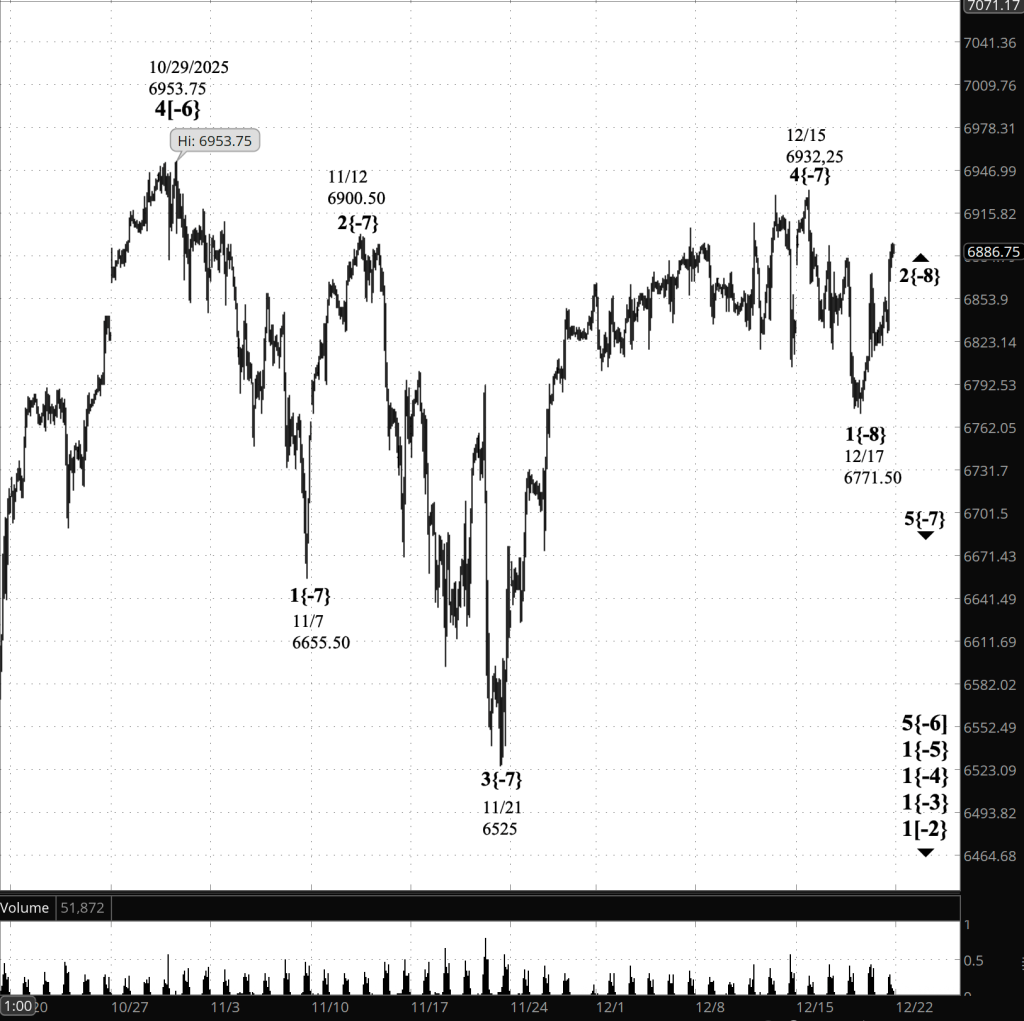

What’s happening now. The S&P 500 E-mini futures resumed trading overnight at 6900.50 and rose by more than 20 points, reaching a level less than 10 points below the December 15 high.

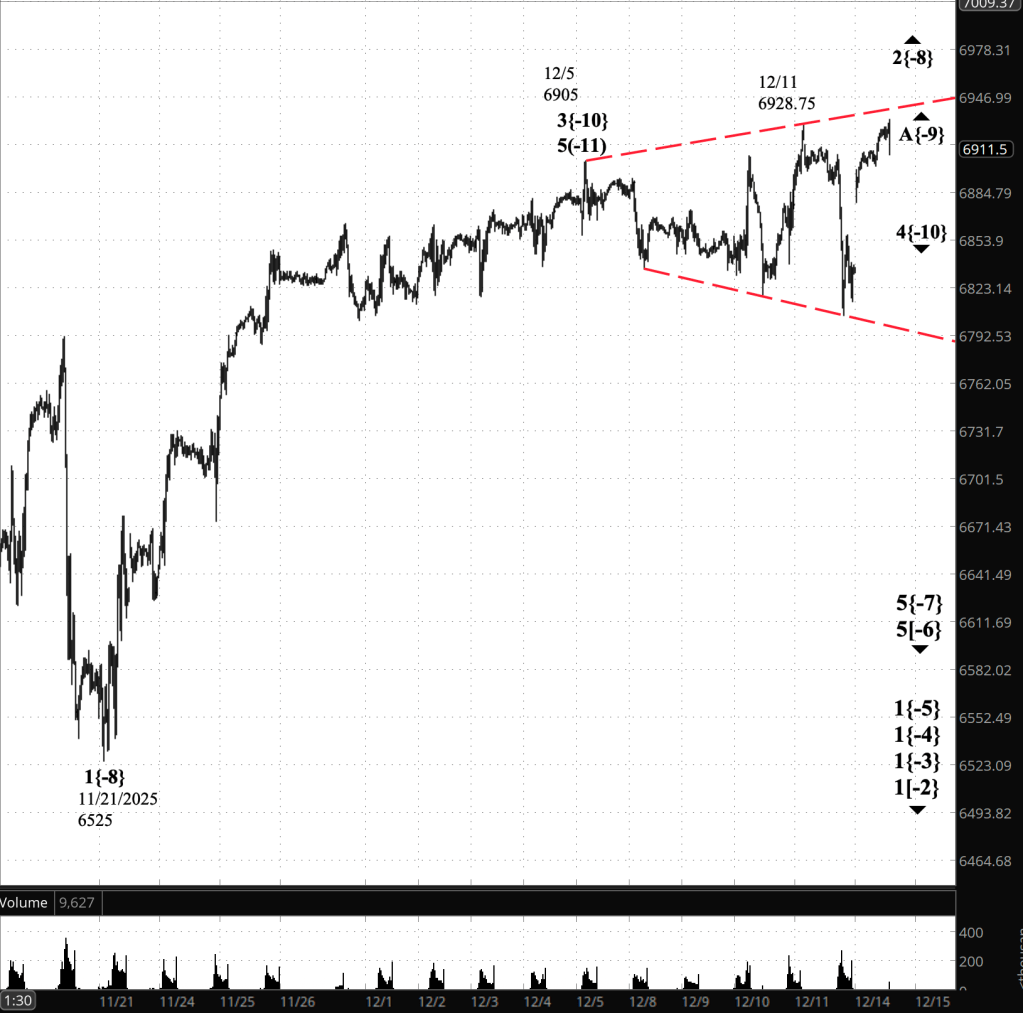

What does it mean? Applying Elliott Wave Theory analysis, it is clear that the upward correction that began on December 17 from 6771.50, wave 2{-8}, continues. It is a subwave of wave downtrending wave 5{-7} and it is approaching the start of the preceding 1st wave, wave 1{-8}, on December 15.

Internally, wave 2{-8} appears to ne in its 3rd subwave, rising wave C{-9}. I hedged the description because corrective subwaves tend to be somewhat unclear.

When wave 2{-8} does reach its end, it will be followed by downtrending wave 3{-8}.

But there’s a gotcha looming on the horizon. Here’s a description from the AI I work with for analysis, ChatGPT-5.2. in Thinking mode.

“We’re late in 2{-8} up, and price is now pressing into the completion / invalidation cluster at 6930–6940, with 6932.25 (12/15) as the hard line in the sand. My working bias is still your read: C{-9} up is in progress and likely close to completion. Action: treat 6932.25 as the decision-point. If we reject from just under/around that level and then start taking out prior swing supports (first ~6885, then ~6823), I’ll assume 2{-8} is done and we’re transitioning into 3{-8} down. If we break above 6932.25 and hold, the ‘1{-8} down then 2{-8} up’ interpretation loses its footing and we should stop forcing a 1–2 setup.

“If 6932.25 breaks, the replacement count I’d reach for is: the 12/17 low at 6771.50 was not 1{-8}, but the A{-8} low (or a larger-degree A within a broader correction), and the current rise is not a mere 2{-8} but a continuation of the larger uptrend—i.e., we’re building a stronger B{-8} (or even an early 3{-8}) advance that can legitimately take out the prior high. Practically: above 6932.25, I’d shift from ‘top-hunt and short-trigger’ to ‘accept higher highs, wait for a new down-set (5-wave) to prove itself,’ because the market would be telling us the down leg was corrective, not impulsive.”

[S&P 500 E-mini futures at 3:30 p.m., 90-minute bars, with volume]

Waves Now Underway

These are the waves currently in progress under my principal analysis. Each line on the list shows the wave number, with the subscript in curly brackets, the traditional degree name, the starting date, the starting price of the S&P 500 E-mini futures, and the direction of the wave.

Most of the waves began not long ago, on October 8, 2025. See my essay posted on October 12, 2025, “The End of the Rise from 1932? Elliott Wave Theory Says ‘Yes’”, for a discussion of how that happened.

The difficult problem of estimating when a wave change should be accept as real rather than a headfake is addressed by the essay titled, “Is This Reversal Real?: How to Tell Without Being Whipsawed”.

- 1{+4} Supermillennium, (unknown start date or start price) {down}

- A hypothetical wave one degree higher than Supercyle, needed to make the wave analysis complete.

- S&P 500 Index:

- 1{+3} Supercycle, 10/8/2025, 6812.25 (down}

- 1{+2} Cycle, 10/8/2025, 6812.25 (down}

- 1{+1} Primary, 10/8/2025, 6812.25 (down}

- 1{0} Intermediate, 10/8/2025, 6812.25 (down}

- 1{-1} Minor, 10/8/2025, 6812.25 (down}

- 1{-2} Minute, 10/8/2025, 6812.25 (down}

- S&P 500 Futures

- 1{-3} Minuette 10/8/2025, 6812.25 (down}

- 1{-4} Subminutte 10/8/2025, 6812.25 (down}

- 1{-5} Micro, 10/8/2025, 6812.25 (down}

- 5{-6} Submicro, 10/29/2025, 6953.75 (down)

- 4{-7} (none), 11/21/2025, 6932.25 (up)

- C{-8} (none), 12/17/2025, 6771.50 (up)

Reading the chart. Price movements — waves – – in Elliott Wave Theory analysis are labeled with numbers within trending waves and letters with corrective waves. The subscripts — numbers in curly brackets — designate the wave’s degree, which, in Elliott Wave analysis, means the relative position of a wave within the larger and smaller structures that make up the chart. R.N. Elliott, who in the 1930s developed the form of analysis that bears his name, viewed the chart as a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

Learning and other resources. Elliott Wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott Wave analysis.

By Tim Bovee, Portland, Oregon, December 22, 2025

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on work at www.timbovee.com

You must be logged in to post a comment.