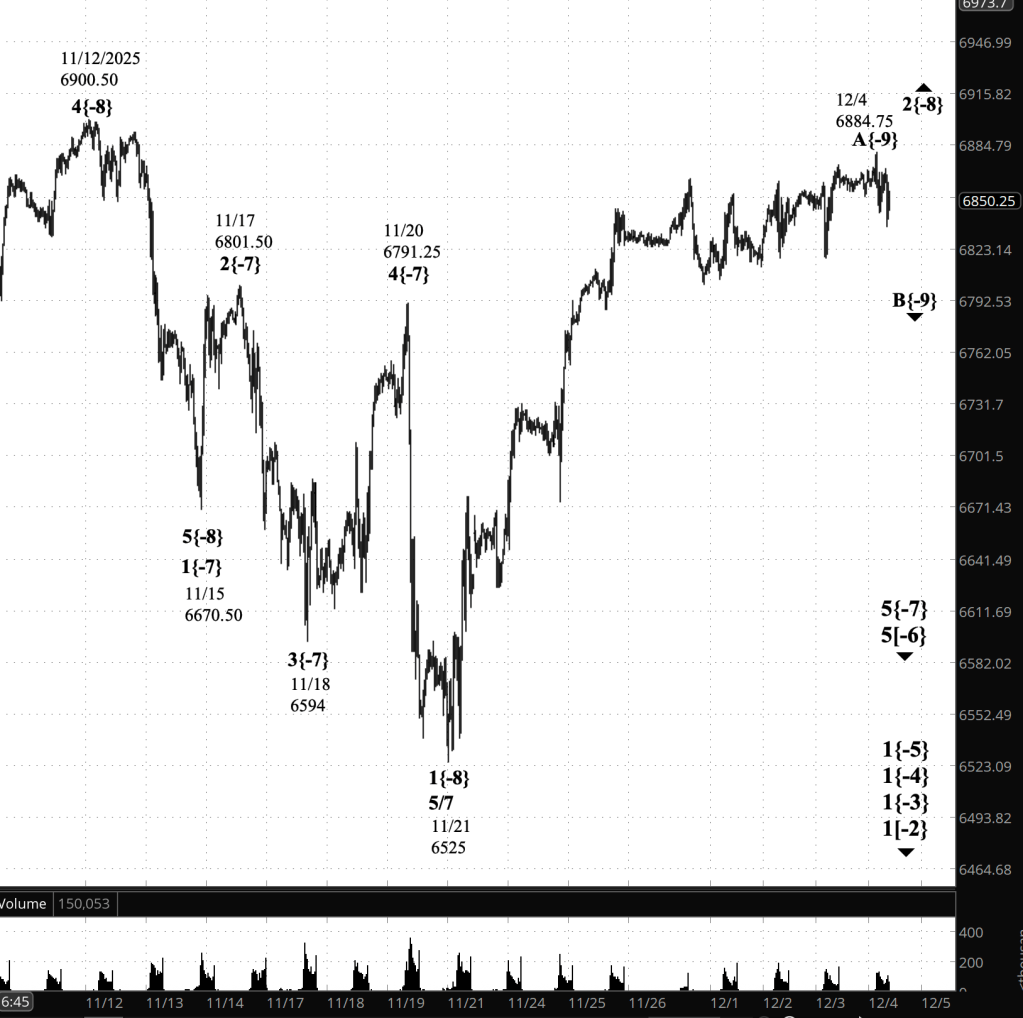

3:30 p.m. New York time

Half an hour before the closing bell. The S&P 500 futures reversed early in the session, falling from the 6890s so far into the 6830s.

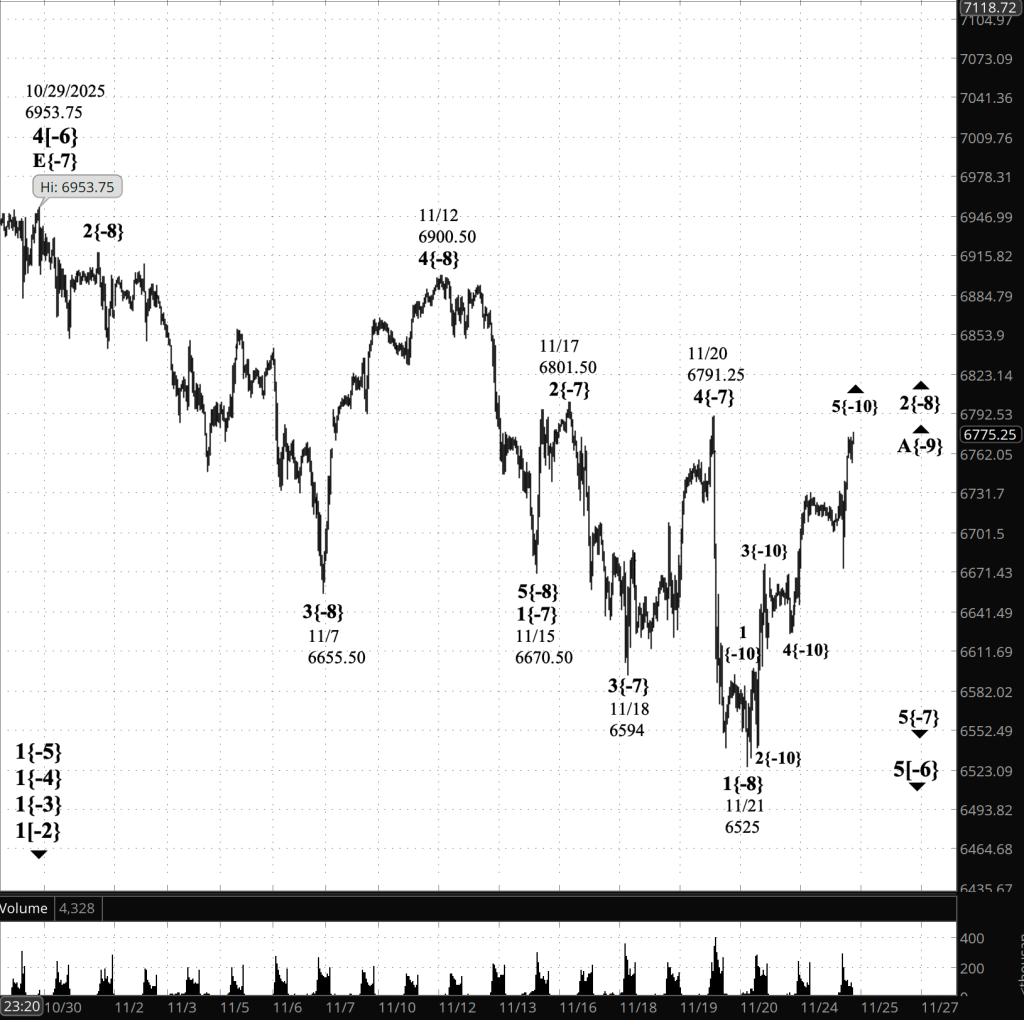

Elliott Wave Theory: The brisk fall again potentially means wave B{-9} within rising correction wave 2{-9} raises the question of the legitimacy of the new wave. As often as not, I’ve found, many “new” waves turns= out to be old-wave headfakes.

This time, however, there may be less ambiguity. ChatGPT writes: “This drop makes the question sharper because it punched through the first “line of defense” (the 6845–6855 area) and is now forcing the market to prove that the late-November advance is more than a one-way squeeze. On the chart, the 12/5 high at 6905 still reads as a plausible termination point for wave A{-9} within 2{-8}, and today’s slide to roughly 6842 is exactly what a trader sees at the start of a wave-B style retracement—unless it quickly stabilizes and reasserts the prior uptrend. From here, the ‘Is this reversal real?’ filter is straightforward: if price holds the ~6823 shelf, rebounds, and can reclaim 6855 without rolling over again, then today’s decline can still be treated as a corrective dip inside an ongoing reversal attempt. But if ES breaks 6823 with momentum and then any bounce fails below 6855–6885, the odds shift toward ‘A is done and B is underway,’ with 6791.25 becoming the next key ‘not proven’ trigger.”

[Suggested reading: The essay titled, “Is This Reversal Real?”, with the subtitle, “How to Tell Without Being Whipsawed.”]

There’s not enough evidence for action yet. Among other things, I’m looking for a bear call options vertical bear call spread position, in line with the downtrending nature of the parent waves several degrees higher. The daily Ehlers Stochastic on SPY, the ETF that, like the futures, is based on the S&P 500 index, is in overbought territory — a plus — but it hasn’t broken below the 1.0 bar at the top, which signals that the downward run truly has begin.

Looming over it all is the Federal Open Market Committee meeting to change interest rates. Their statement will be released Wednesday at 2 p.m. New York time, with a news conference with Fed Chair Jerome Powell scheduled for a half an hour later. Potential, either will be a complicating factor in the market’s behavior and therefore in the timing of the waves.

9:35 a.m. New York time.

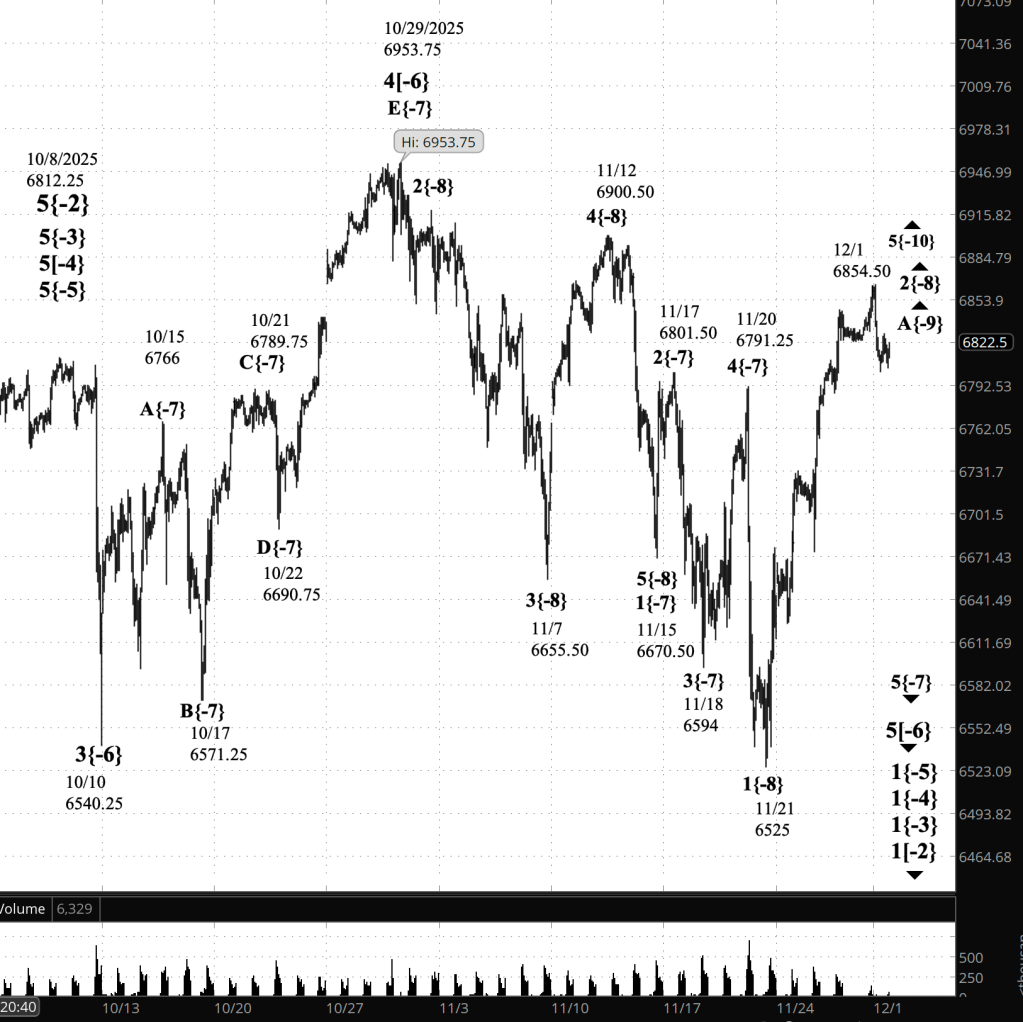

What’s happening now. The S&P 500 E-mini futures .traded narrowly when trading resumed, opening in the 6870s and reaching the 6890s as the session’s opening bell drew near. The price remained below the high so far, 6906, in the rise that began on November 21.

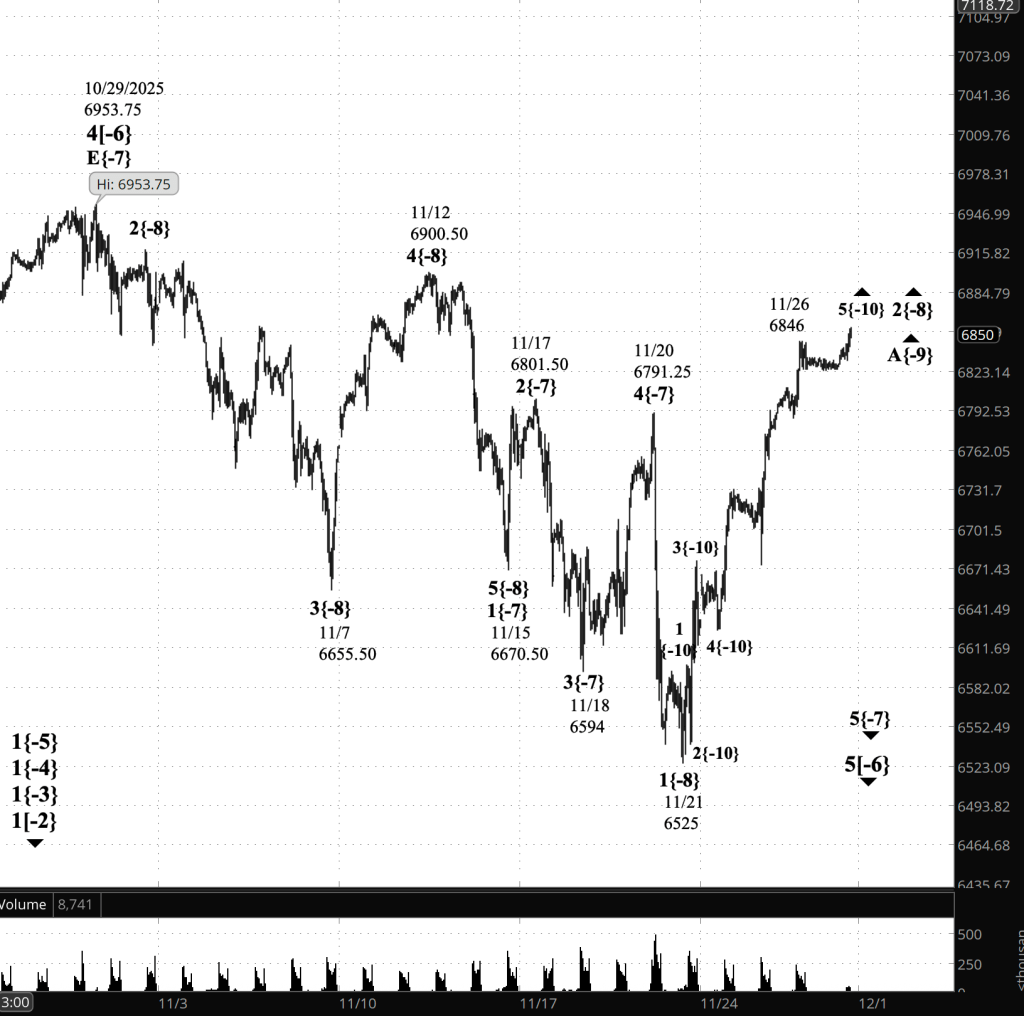

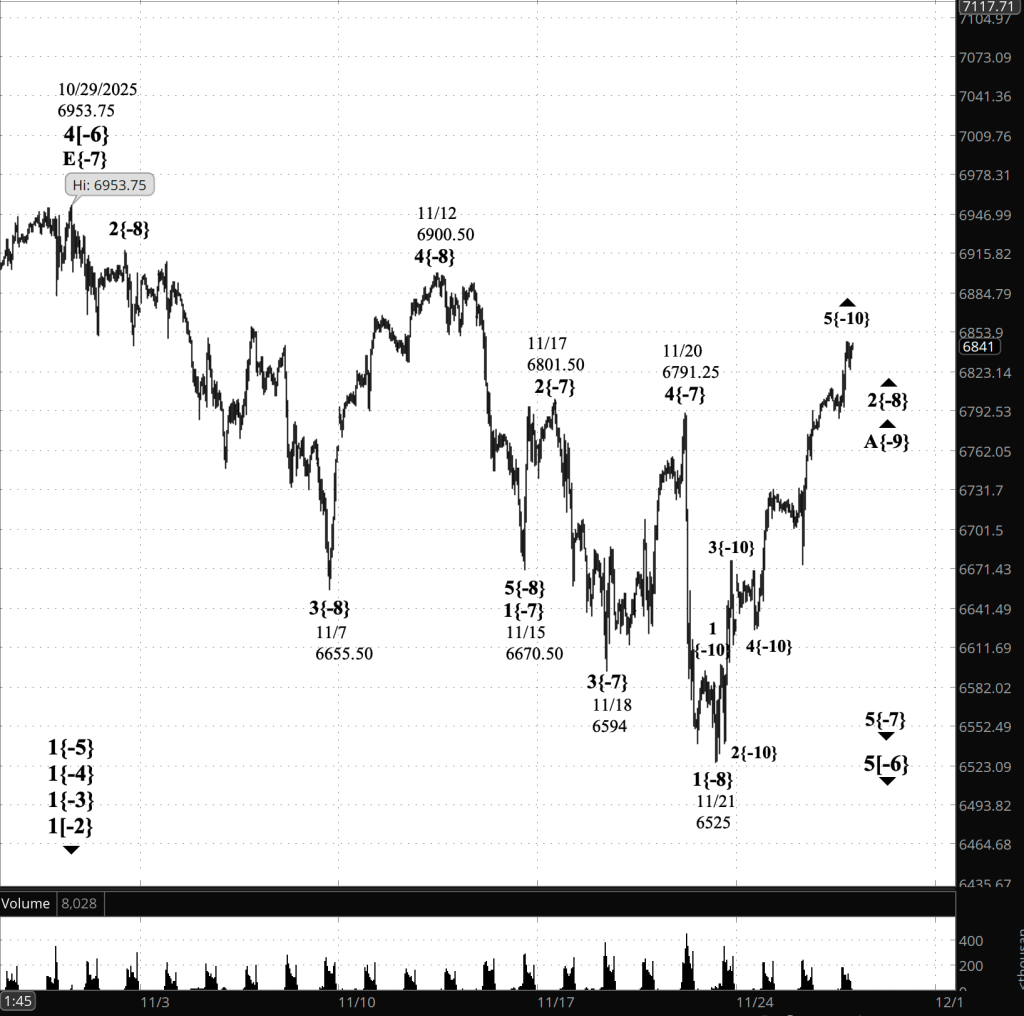

What does it mean? That rise, wave A{-9} on the chart, is the initial subwave in the upward correction, wave 2{-8}. The chart today presents Elliott Wave Theory with the same question it has faced every day since late November: Is this reversal real? Every new high, followed by a reversal, can be interpreted as as the end of rising wave A and the beginning of falling wave B. And yet, the present rise, it has never turned out that way.

There are methods that, when applied, reduce the rate of false conclusions in analyzing the chart. This morning, shortly before publishing this analysis, Trader’s Notebook, I posted an essay on that subject that I highly recommend to traders trying to make sense charts.

The essay is titled, “Is This Reversal Real?”, with the subtitle, “How to Tell Without Being Whipsawed.”

I asked the author of the essay to apply the methods to the chart. It’s answer:

“On this 40-minute ES chart, the “Is this reversal real?” question basically comes down to whether the 11/21 washout low at 6525 has truly flipped the market into a durable higher-high / higher-low sequence—or whether the surge is just a sharp countertrend rally that’s about to fade. The rally leg into 6905 (12/5) is the kind of thrust you want to see at the start of a reversal, but the fact that we’re not printing a fresh high yet today suggests we’re still in a prove-it phase: either a normal pause (think wave-2/B style consolidation after the first reversal push) or the early warning of rejection. For the reversal to look “real,” any dip should stay corrective and defend the prior structure (first line around the 6845–6855 area, then the ~6823 shelf); a slip back under the 11/20 6791.25 pivot would be the cleanest “not proven” signal. Conversely, a push through 6905 followed by acceptance (holding above it, not just tagging it) would be the simplest confirmation that buyers still control the turn.”

[S&P 500 E-mini futures at 3:30 p.m., 45-minute bars, with volume]

Waves Now Underway

These are the waves currently in progress under my principal analysis. Each line on the list shows the wave number, with the subscript in curly brackets, the traditional degree name, the starting date, the starting price of the S&P 500 E-mini futures, and the direction of the wave.

Most of the waves began not long ago, on October 8, 2025. See my essay posted on October 12, 2025, “The End of the Rise from 1932? Elliott Wave Theory Says ‘Yes’”, for a discussion of how that happened.

- 1{+4} Supermillennium, (unknown start date or start price) {down}

- A hypothetical wave one degree higher than Supercyle, needed to make the wave analysis complete.

- S&P 500 Index:

- 1{+3} Supercycle, 10/8/2025, 6812.25 (down}

- 1{+2} Cycle, 10/8/2025, 6812.25 (down}

- 1{+1} Primary, 10/8/2025, 6812.25 (down}

- 1{0} Intermediate, 10/8/2025, 6812.25 (down}

- 1{-1} Minor, 10/8/2025, 6812.25 (down}

- 1{-2} Minute, 10/8/2025, 6812.25 (down}

- S&P 500 Futures

- 1{-3} Minuette 10/8/2025, 6812.25 (down}

- 1{-4} Subminutte 10/8/2025, 6812.25 (down}

- 1{-5} Micro, 10/8/2025, 6812.25 (down}

- 5{-6} Submicro, 10/29/2025, 6953.75 (down)

- 5{-7} Minuscule, 11/20/2025, 6791.25 (down)

- 2{-8} (none), 11/21/2025, 6525 (up)

- A{-9} (none), 11/21/2025, 6525 (up)

Reading the chart. Price movements — waves – – in Elliott Wave Theory analysis are labeled with numbers within trending waves and letters with corrective waves. The subscripts — numbers in curly brackets — designate the wave’s degree, which, in Elliott Wave analysis, means the relative position of a wave within the larger and smaller structures that make up the chart. R.N. Elliott, who in the 1930s developed the form of analysis that bears his name, viewed the chart as a complex structure of smaller waves nested within larger waves, which in turn are nested within still larger waves. In mathematics it’s called a fractal structure, where at every scale the pattern is similar to the others.

Learning and other resources. Elliott Wave analysis provides context, not prophecy. As the 20th century semanticist Alfred Korzybski put it in his book Science and Sanity (1933), “The map is not the territory … The only usefulness of a map depends on similarity of structure between the empirical world and the map.” And I would add, in the ever-changing markets, we can judge that similarity of structure only after the fact.

See the menu page Analytical Methods for a rundown on where to go for information on Elliott Wave analysis.

By Tim Bovee, Portland, Oregon, December 8, 2025

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on work at www.timbovee.com

You must be logged in to post a comment.