SPDR S&P 500 ETF (SPY)

Update 3/31/2017: SPY rose continually after I entered the position. I exited with 21 days before expiration and with the profit at 6% of its maximum potential. Further upward movement will make the position unprofitable.

My goal was 25% of the maximum, but I decided to eliminate the risk of a loss for two reasons.

First, the spread I constructed had quite a narrow profit zone. That’s what the options grid allowed. In retrospect, it might have been better to have simply passed on the trade.

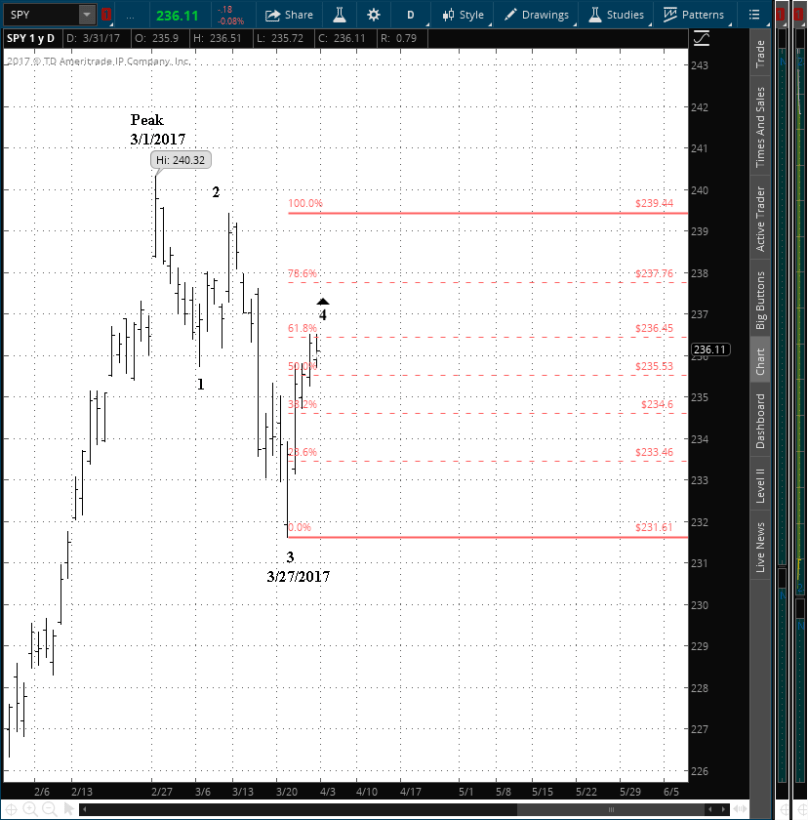

Second, the Elliott wave analysis of short-term movements presents an uncertain view of the future. I count the price as having being in an A wave upward retracement of a 3rd wave to the downside within a higher-level downward movement that began on March 1. The upward thrust has retraced a Fibonoacci 61.8% of the 3rd wave, reaching a common reversal point.

Fibonacci retracements come with no guarantees. Moreover, a 4th wave like as not will take a sideways form, such as a Flat. Rather than risk the loss, it made more sense to me to take what profits I could and come back another day with a structure more likely to succeed.

Shares rose by 1.2% over seven days, or a +64% annual rate. The options position produced a 6.4% yield on debit for a +336% annual rate.

SPY’s implied volatility has risen to a relatively high level within a very narrow range.

I shall use the apr series of options, which trades for the last time 28 days hence, on April 21.

Implied volatility stands at 13% and, by definition, is nearly identical with the VIX, a measure of the volatility of the S&P 500 index.

SPY’s IV stands in the 21st percentile of its annual range and the 79th percentile of its most recent broad movement.

The price used for analysis was $234.00.

| Premium: | $3.97 | Expire OTM | |

| SPY – iron fly | Strike | Odds | Delta |

| Calls | |||

| Long | 238.00 | 76.0% | 25 |

| Break-even | 237.47 | ||

| Short | 233.50 | 50.3% | 51 |

| Puts | |||

| Short | 233.50 | 49.7% | 49 |

| Break-even | 229.53 | ||

| Long | 228.00 | 73.4% | 25 |

The premium is 79% of the width of the position’s wings.

The risk/reward ratio is 0.9:1.

Decision for My Account

I have entered a position on SPY as described above. The stock at the time of entry was priced at $233.59.

By Tim Bovee, Portland, Oregon, March 24, 2017

[…] entered positIon on SPY based on a high position within a very narrow range and exited COST for a […]

LikeLike

[…] the eight, GME and SPY are profitable, as is the remnant of my TGT positions that was broken apart by an assignment. ORCL, […]

LikeLike