11:05 a.m. New York time

Chart analysis is much like the old-time serial films they used to show in movie theaters, where each episode ended with a cliff-hanger, and the kids had to shell out their nickels again to see what happened.

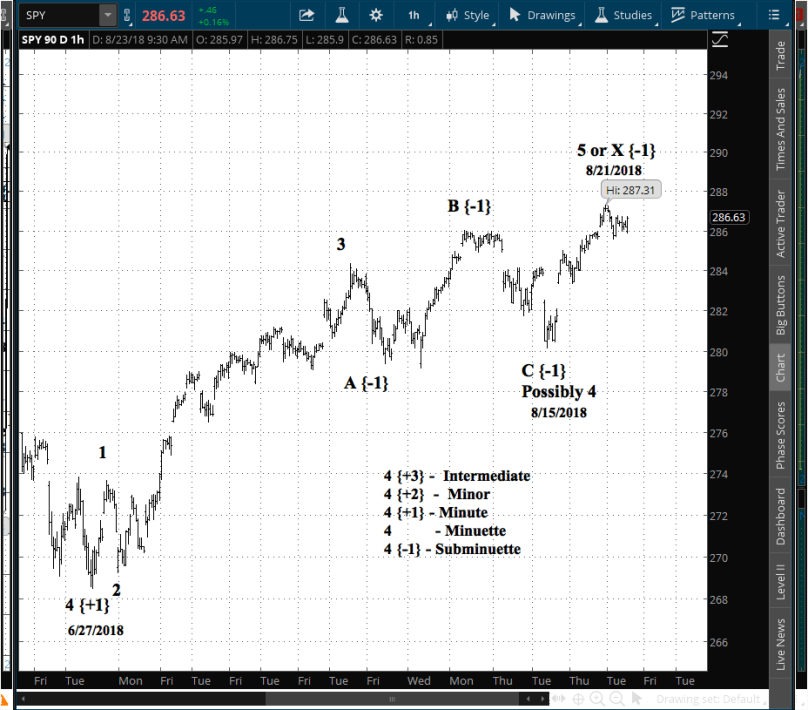

Having revised my longer-term Elliott Wave analysis of the SPY chart from the Jan. 26 beginning of the bear market, I took a deeper dive into components of the uptrending 4th wave of Minute degree {+1}, which began June 27.

The SPY chart covers 90 days with hourly bars.

The interesting part is the leg up beginning Aug. 15, a movement that has much ambiguity. A straightforward count shows the C wave down of the Subminuette degree {-1} ended on Aug. 15.

If that wraps up the countertrend correction then that is also the end of the 4th wave and we are now pushing upward on the 5th and final wave of the C wave of Minute degree that began in April. (See the chart posted yesterday.)

However, the subsequent upward move could also prove to be the separating wave of a complex correction, with several zig-zags or flats or other corrective patterns linked to together. In Elliott, the separating waves are labeled X, and in this case it would be an X wave of Subminuette degree.

If the upward move from Aug. 15 is a 5th wave, then it will mean continued upward movement to a greater or lesser extent, followed by a significant down move, wave 3 of the Intermediate degree {+3}.

If the upward move is an X wave, then it has likely completed most its rise, and what follows will be a downward move, but not a major one, with a lower boundary on SPY in the $270s or so.

Bottom line: We don’t know which it will be. It’s a cliffhanger. We’ll need to pony up our nickels to see the next episode.

By Tim Bovee, Portland, Oregon, Aug. 23, 2018

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.L

[…] referred to that possibility in my analysis of Aug. 23 (although the degree labeling has since […]

LikeLike