ARKG Genomic Revolution Multi-Sector ETF (ARKG)

Update 7/10/2018: I have exited ARKG for a small profit. My fundamental reason for buying ARKG — growth of the genetics sector — remains valid. However, we have been in a bear market since Jan. 26, and ARKG has moved into a down wave. I took my chips off the table — temporarily — in order to let that wave do its work without impacting me, and I shall jump back in once that wave is complete.

Shares produced a net rise of 3.1% over my 25-day holding period, for a +46% annual rate.

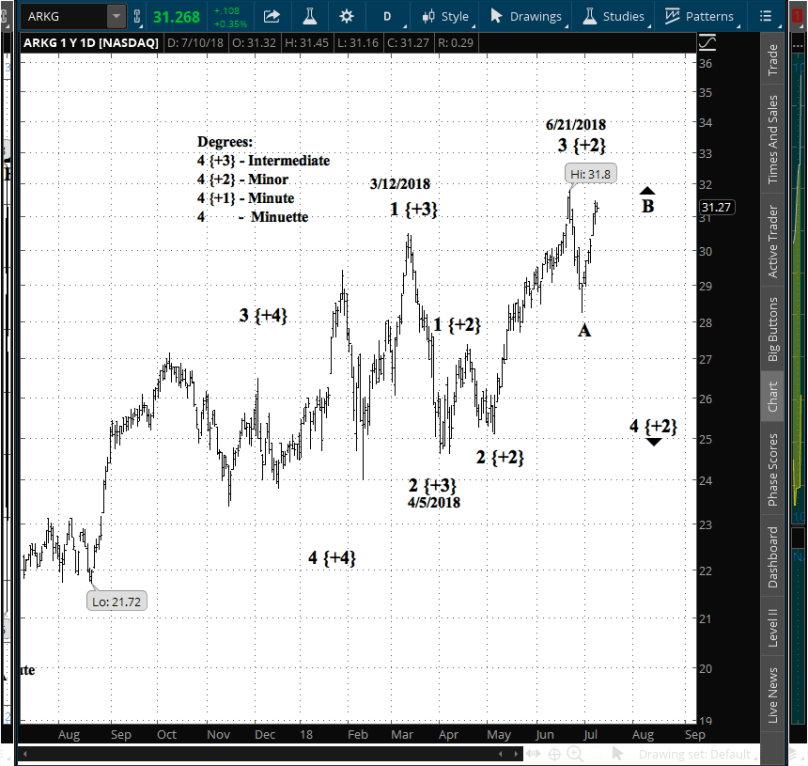

The ARKG chart below, covering one year with daily bars, shows that at the Minor degree the stock is in an uptrend and has begun a counter-trend correction at the Minute and Minuette degrees.

The 4th wave is generally a sideways movement, and often a complex one. That means a shallow correction but one that will take some time to complete. It will be followed by a 5th wave rise to new highs.

My plan is follow the Minute wave and trade the reversal to the upside of the Minor wave.

Update 6/17/2018: After buying into ARKG I have spent the weekend learning more about the fund’s creator and manager, ARK Investment Management LLC. Among my finds was this half-hour interview with ARK’s CEO, Catherine D. Woods, in which she discusses the company’s disruptive technologies themes. Interesting ideas.

I have entered a long shares position on ARKG, one of the few exchange-traded funds with an uptrending Fisher Transform and a visual trend on the annual chart to match.

I have structured it as a longer-term trade, a traditional buy-and-hold. The chart doesn’t follow the normal movements of the broad market, and in this bear market, I judge that outliers give the best prospects.

I screened for it in the simplest possible way: Listing all of the available exchange-traded funds, the huge majority of which are downtrending, and looking at those few with an uptrending Fisher. After that, it was just a matter of skimming through the charts.

The fund has no Zacks rank but is considered to be high risk. It pays no dividend and has no options. Morningstar gives it a 3-star rating.

The entry price was $30.22.

Atypically for me, ARKG is a story trade. I’m fascinated by genomics and all the useful information that can be harvested from a genetic test. Like millions of others, I’ve been tested by 23andMe (Wikipedia article), and have learned more about myself, my limits and gifts, my likely health challenges and I age, than my parents could have ever hoped to know.

Running my testing results through Promethease, I linked my results to the broad scientific literature tracked by SNPedia (Wikipedia article) for an even deeper knowledge of myself.

After much reading, I’m convinced that this tech is the Next Big Thing, and I want to go along for the ride. Plus, ARKG is classified as a Health Care ETF. I judge that we are in the last stage of the expansion that began in October 2009, a stage in which Health is a sector that does well.

ARKG is newly uptrending on the monthly Fisher Transform, and I shall use a switch to downtrending on that indicator as a signal to pull out temporarily.

By Tim Bovee, Portland, Oregon, June 15, 2018

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decisions for his or her own account, and take responsibility for the consequences.

All content on Tim Bovee, Private Trader by Timothy K. Bovee is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Based on a work at www.timbovee.com.

[…] I have entered a shares position on ARKG. […]

LikeLike

[…] parent company, ARK Invest, and found its approach to be be fascinating. I’ve updated my ARKG analysis with a half-hour interview with the company’s CEO, Catherine […]

LikeLike

[…] shares position on ARKG continues to tick-tock along a rising 5th wave of the Primary degree. It has fulfilled all of the […]

LikeLike

[…] wave analysis of SPY and ARKG still stand, and there has been no change in the Fisher Transform directional signals on either. […]

LikeLike

[…] ARKG has set a lower low for two days in a a row for the first time since June 4, and the daily chart Fisher Transform has switched to downtrending. It has been uptrending since June 13. The weekly chart Fisher remains uptrending, as it has been since mid-May. The weekly is my chosen signal to consider exiting to avoid a downtrend. […]

LikeLike

[…] gapped to the downside at the open, and my other holding, ARKG, gave a powerful push […]

LikeLike

[…] gapped to the downside at the open, and my other holding, ARKG, gave a powerful push […]

LikeLike

[…] changes in my analysis of my positions in SPY and ARKG. I anticipate no trades […]

LikeLike

[…] ARKG continues its downward course, having traced a very low level mini-correction to the upside over the last few days. […]

LikeLike

[…] No change this morning in my chart analysis of my positions in SPY and ARKG. […]

LikeLike

[…] SPY and ARKG, my main positions, show no need for trades today. […]

LikeLike

[…] trades in sight today. The analysis of my SPY and ARKG positions is […]

LikeLike

[…] Elliott wave analyses of SPY and ARKG, posted June 25, continue to play out. I anticipate no trades […]

LikeLike

[…] have revisited the lower degrees of my SPY and ARKG analysis. Neither requires a trade this […]

LikeLike

[…] anticipate no exits from my existing positions, SPY and ARKG, and no other trades today. See the chart analysis posted on […]

LikeLike

[…] wave count. I shall wait to gain some clarity about the chart before posting a re-analysis. ARKG is moving as […]

LikeLike

[…] ARKG is marking a B wave to the upside before beginning a 3rd wave down. I count the C wave has having nearly completed five waves up, and so I shall take my profit today in order to avoid the coming decline. […]

LikeLike